Current trends for biosimilars in the Latin American market

Published on 2020/03/25

Generics and Biosimilars Initiative Journal (GaBI Journal). 2020;9(2):64-74.

Author byline as per print journal: Esteban Ortiz-Prado1,2, MD, MSc, MPH, PhD; Jorge Ponce-Zea3, MSc; Jorge E Vasconez1, MD; Diana Castillo,1, MD; Diana C Checa-Jaramillo1, MD; Nathalia Rodríguez-Burneo1, MD; Felipe Andrade2, MD; Damaris P Intriago-Baldeón4, MSc; Claudio Galarza-Maldonado5, MD, PhD

|

Abstract: |

Submitted: 7 January 2020; Revised: 10 April 2020; Accepted: 23 April 2020; Published online first: 6 May 2020

Introduction

Biological medicines have become a major market for the pharmaceutical industry, the biologicals market was valued at US$ 254.9 billion in 2017 and is expected to reach US$ 580.5 billion by 2026 at a compound annual growth rate (CAGR) of 9.5% during the forecast period from 2018 to 2026 [1]. In the coming five years, the patents of many essential biological medicines such as Cosentyx, Kadcyla, Removab or Soliris will expire, providing opportunities for biosimilar development [2–4].

Biosimilars can be defined as biotherapeutic products which have no statistically significant differences in quality, safety and efficacy to an already licensed reference biotherapeutic [5]. Unlike small molecule generics, biologicals are larger and more complex and therefore production can be difficult to standardize, even within the same manufacturer [6].

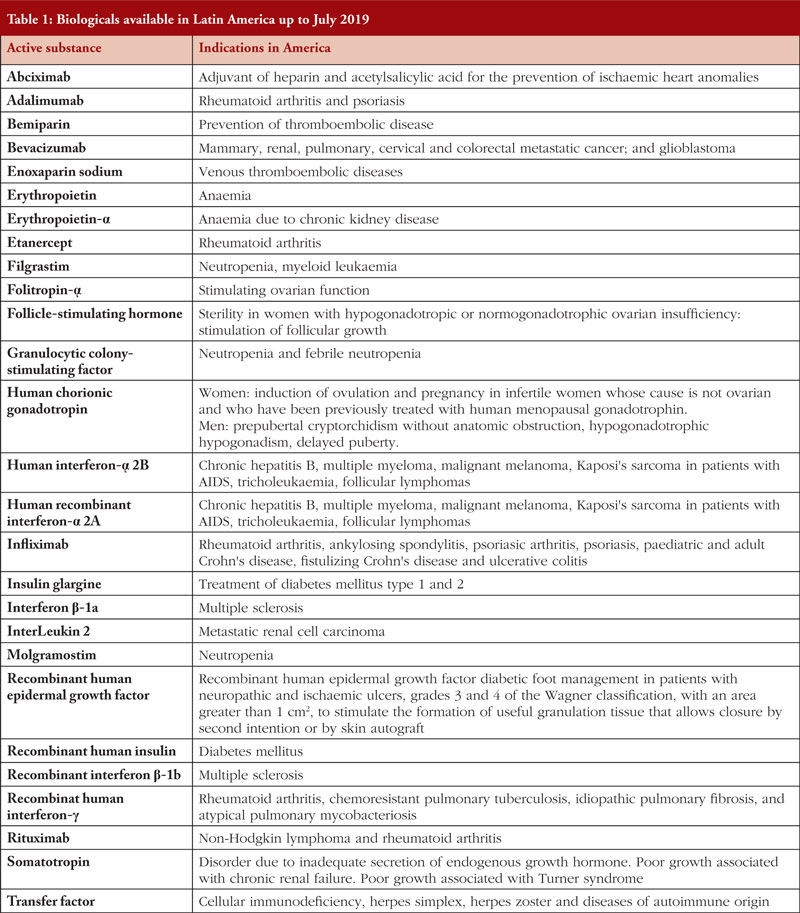

The first biosimilar approved in the European Union (EU) was the human growth hormone Omnitrope (somatotropin) in 2006. By end of 2019, 64 biosimilars within the product classes of (1) human growth hormone; (2) granulocyte colony-stimulating factor; (3) erythropoiesis stimulating agent; (4) insulin; (5) follicle-stimulating hormone (FSH); (6) parathyroid hormone; (7) tumour necrosis factor (TNF)-inhibitor; and (8) monoclonal antibodies have been approved in the EU [7]. In contrast, 26 biosimilars within the product classes of (1) anti-tumour necrosis factor-alpha (TNF-α); (2) monoclonal antibodies; and (3) granulocyte colony-stimulating factor, plus four follow-on biologicals in the product classes of insulin (Admelog, Basaglar and Lusduna) and teriparatide (PF708), have been approved in the US [8], while 94 biological and biosimilar products including biomimics for 27 biological molecules have marketing authorization in Latin America, see Table 1.

Biosimilars have changed the dynamics of the biologicals market and lowered healthcare costs. They also represent a market opportunity for small and medium-sized pharmaceutical companies that cannot afford to develop new biological medicines. Generally, the development of biosimilars involves lower production costs; the estimated cost of developing and gaining approval for a biosimilar ranged between US$100 million and US$200 million [9, 10], compared to an average cost of US$1.3 billion of bringing a new originator drug to market [11].

An estimated 182 companies around the world are trying to market biosimilars [12]. These companies are reshaping the global pharmaceutical market by lowering prices for biological drugs. Examples of world leading companies include Amgen, Biogen, Merck & Co, Pfizer, Sandoz and Teva; companies that are based in Europe, Israel and the US. Although most leading companies are based in high-income countries, Asian nations such as China, India and South Korea are gaining increasing market share [13]. The future may appear brighter for developed nations, due to their technical facilities, capital availability and market opportunities, however, biosimilar development in the Latin American region is also developing [14].

The context for the development of biosimilars in Latin America is highly diverse due to peculiarities related to economic, political, regulatory and cultural factors. The nature of government policies, regulatory agencies, public and private health providers, payers, multinational pharmaceutical companies, local companies, physicians and patients differ in every Latin American country, each of which has a unique market and regulatory landscape [15].

Methods

Study design and setting

This is a descriptive analysis of the evidence surrounding the market for biosimilars and biological products in Latin America. This review offers an insight into the biosimilar products being developed in Latin America and can be classified as an ‘expert literature review’, according to Grant’s classification [16]. The search and analysis were conducted from Ecuador, South America using the DelphiS cross-searching tool, which searches across the University of Southampton’s printed and electronic resources, as well as major subject databases and indexes.

Data sources

Information from primary and secondary sources were obtained via EBSCO research databases using the DelphiS library engine. Databases included the following: EBSCO, JSTOR, Clarivate Analytics, PubMed/Medline, OVID, ScienceDirect, Web of Science, EMBASE and Europe PMC.

Search strategy

Indexed manuscripts were retrieved using the Boolean operators AND/OR in combination with the words ‘biosimilar’, ‘biosimilares’ (Spanish), ‘biological drugs’ or ‘medicamentos biologicos’ (Spanish). This search combined the term ‘South America’ and the word ‘Latin’, using the truncation mark (*) to include all documents that contain the specified word at the beginning of the search with the word ‘market’, in both English and Spanish.

Inclusion and exclusion criteria

All manuscripts that described the biosimilar market in Latin America were included. Manuscripts that did not contain the word ‘market’ in the title or abstract were excluded.

Study selection and analysis

In addition to research papers, trade publications, government documents, official statistics and technical reports were also included in the analysis. With the collected data, a description and analysis of the current situation regarding the development of biosimilars in each Latin American nation were performed by the authors. Similarities between countries were discussed, and strategies for optimized biosimilar development were proposed. A separate search was performed for each country (Argentina, Bolivia, Brazil, Canada, Chile, Colombia, Cuba, Dominican Republic, Ecuador, El Salvador, Honduras, Mexico, Nicaragua, Panama, Paraguay, Perù, Uruguay, Venezuela and the US) included in this manuscript. After the results were obtained, we combined the search. All relevant scientific publications published between January 1990 to December 2017 were reviewed against the inclusion and exclusion criteria by four members of our team.

Appraisal of the literature

All manuscripts included in the literature review were critically appraised using the Critical Appraisal Skills Programme tool (CASP checklist) for the specific type of article. This tool aims to identify potential threats to the validity of the research findings while offering a quantitative evaluation of every study.

Leading players in the Latin American biosimilar market

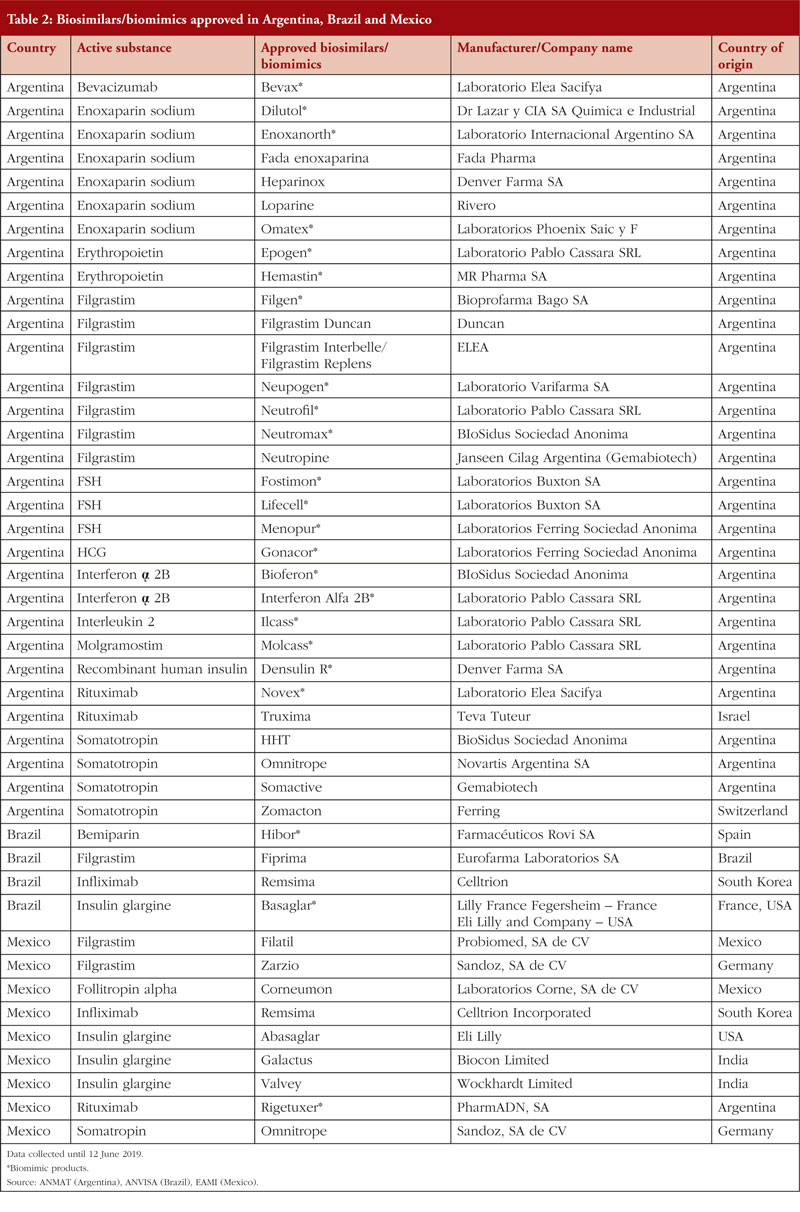

Argentina, Brazil and Mexico have the largest number of approved biosimilars/biomimics in Latin America; with 44 products approved in total, see Table 2.

Argentina

Argentina

The Argentinian biosimilar industry was established in 1983 with the creation of Biosidus, the company that made the first biosimilar in South America, erythropoietin, which was released onto the market in 1990. There is growing interest in the development of the biosimilar industry in Argentina, which is supported by government policies. This is described in the government’s Science and Technology plan, Argentina Innovadora 2020: Plan Nacional de Ciencia, Tecnología e Innovación, which outlines public strategies to support the development of the biosimilar value chain [17]. In 2011, Argentina produced 650 million doses of generic and biosimilar drugs, of which domestic laboratories manufactured 63%. Exports in the same period accounted for US$850 million in revenue [18–21]. PharmADN Laboratory of the Grupo Insud was the first facility in South America to produce biosimilar monoclonal antibodies. This achievement constituted a significant milestone for the Argentinian pharmaceutical industry, since such drugs were previously imported at the expense of US$250 million per year [22].

Brazil

In Brazil, biosimilar products represent 2% of the drugs paid for and distributed by the Brazilian government. However, the acquisition of these products accounts for 41% of the Ministry of Health’s total expenditure [23]. This mismatch is likely due to the fact that biosimilars are expensive drugs used to treat a small number of chronic diseases, diseases that are difficult to control if proper treatment is not administered at the right time. In 2011, the government spent US$4.9 billion on importing medicines from eight biopharmaceutical companies, which accounted for 18% of total expenditure [24]. In 2009, Brazil became the 10th largest drug producer in the world; retail sales increase by 82.2% between 2007–2011 and approximately US$5.8 billion–US$10.6 billion was made due to this trading trend [14]. Regarding the regulation of biosimilars, Brazil uses World Health Organization (WHO) guidelines as a foundation for its regulation, but with some adjustments. For example, the Brazilian guidelines include two approval regulations, which have been in force since December 2010, to oversee the registration of new biologicals either using individual development or development by comparability. These regulatory measures were developed to promote the local production of biological drugs and to reduce the cost of these medicines [25].

Mexico

In 2012, Mexico had 180 approved biotechnological medicines, representing more than US$2.3 billion dollars of biosimilars sales [26]. A decree that modified the provisions for the regulation of health supplies was published by the Mexican government in 2013. By November 2014, regulation for the registration of biological and biosimilar medicines was finalized. Mexico is home to the second-largest pharmaceutical industry in Latin America. In 2014, the earnings of the Mexican pharmaceutical industry were US$11,430 billion. In 2015, Mexico was the biggest exporter of pharmaceutical products among the Latin American countries [27].

Andean community of nations: Bolivia, Colombia, Ecuador and Perú

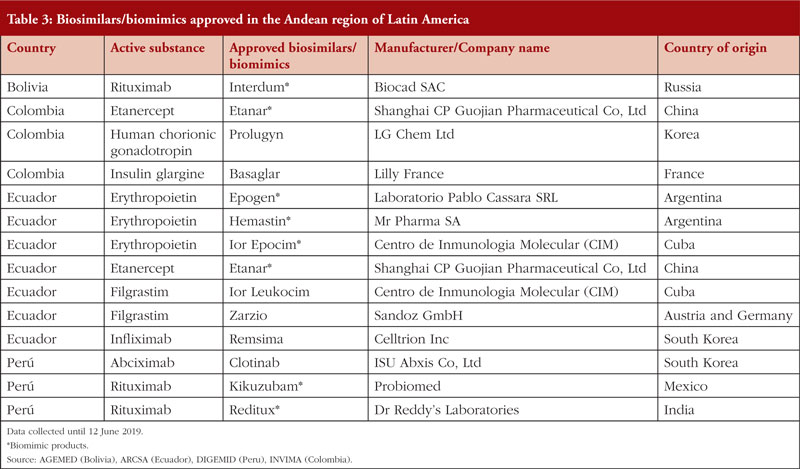

There are overall 14 biosimilars/biomimics approved in the Andean community of nations, see Table 3, which have been produced both within and outside of the Latin American region.

Bolivia

Bolivia

In Bolivia, despite the approval of similar biotherapeutic products (SBPs), the regulatory guideline for SBPs has not yet been formalized by the government [28]. Nevertheless, some companies, such as Biocad, have obtained marketing authorization for their SBPs. The first Russian-made non-originator biological drugs to be launched in Latin America took place in Bolivia and Honduras. No formal information about the profits and/or penetration of those products were found during our search.

Colombia

Sales from the Colombian biomimic market reached US$126,086,839 during 2015–16, according to the Drugs Price Information System (Sistema de Información de Precios de Medicamentos, SISMED) managed by the Government of Colombia [29]. The decree signed in September 2014 intended to reduce the costs of biologicals by 30%–60% [30]. The price difference between originator biological and biosimilars in Latin America can be significant, with some biosimilars being over 50% cheaper than the originator drug [29]. However, national medical information systems in Colombia contain very little information about biological and biosimilar medicines. Furthermore, the guide provided by the Ministry of Public Health and Social Protection (Ministerio de Salud Pública y Protección Social, MSPS) contains limited information regarding the classification and prices of biological and biosimilar drugs currently authorized by the National Institute for Food and Drug Monitoring (Instituto Nacional de Vigilancia de Alimentos y Medicamentos, INVIMA).

Ecuador

In Ecuador, the cost associated with the acquisition of biosimilars is unknown. Nevertheless, due to recent regulatory changes that have facilitated the entry of biosimilars into the country, it is estimated that Ecuador spends at least US$50 million on biological or biosimilar products every year, if both the public and private markets are included [31, 32]. According to the Ministry of Public Health in Ecuador (Ministerio de Salud Pública, MSP), the average selling price of biosimilars (per bottle of injectable product) in the country is US$218 [33, 34].

In 2014, the now closed government-owned pharmaceutical company Enfarma (EP) registered the first biosimilar version of infliximab in Ecuador [32]. Although there are no officially published reports, information suggests that the commercialization of this biosimilar was not successful. Consequently, the innovator product (MabThera) made sales exceeding US$20 million in Ecuador in 2015 [32].

Until recently, biosimilar products have been overtaken by innovators in Ecuador, mainly due to lack of market penetration of biosimilars but also due to unfair commercial practices [35, 36].

Perú

According to data provided by the Ministry of Health in Perú (Ministerio de Salud, MINSA), the National Police Health Directorate (Dirección de Sanidad de la Policia Nacional, DIRSAN) and the social health insurance system (Seguro Social de Salud, EsSALUD), the biotechnological market in Perú, which includes biosimilars, has grown over the last five years. In 2013, expenses related to purchases of biotechnological products reached US$35,561,725. This high expenditure may be related to the fact that there are no domestic manufacturers of biological medicines in Perú; domestic companies only sell finished products [37, 38]. In 2016, the Ministry of Health in Perú released the national biosimilar regulatory framework, which aims to boost the domestic biologicals market in the country.

MERCOSUR: Chile, Paraguay, Uruguay and Venezuela

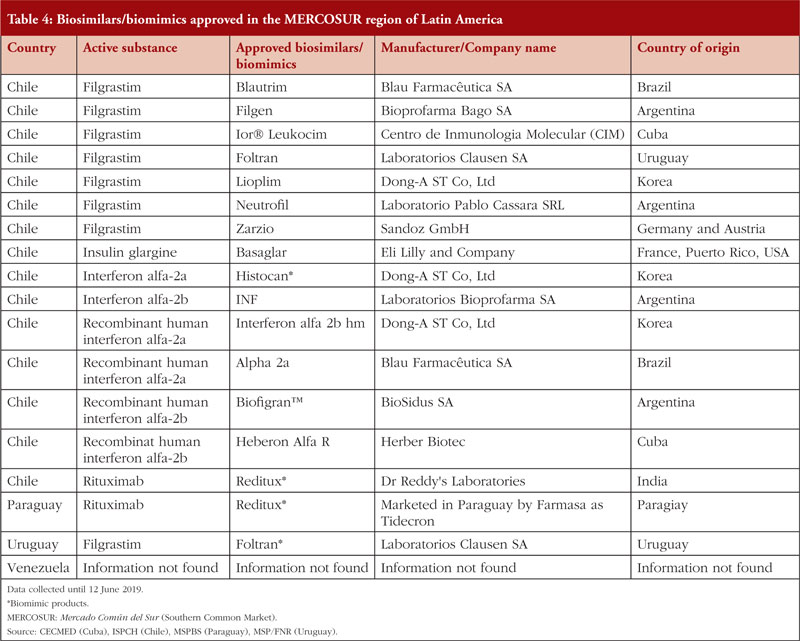

There is a total of 17 biosimilars/biomimics approved in the MERCOSUR trade bloc, the vast majority of which are in Chile. Paraguay and Uruguay each has only one approved biomimic drug, as summarized in Table 4.

Chile

Chile

In 2014, the Technical Standard for the Sanitary Registry of Biotechnological Products derived from recombinant DNA techniques was approved. This landmark approval means biosimilar products may be registered in Chile using international regulations as reported in previous years for the evaluation and approval of these products [39, 40]. Between 2014–2018, the public sector made purchases of biological and biosimilar medicines, equivalent to 26% of the total number of drugs purchased at a value of over US$143,719,000 [41]. Currently, as in Perú, Chile only imports finished biosimilar products [23].

Paraguay

We were able to find limited reliable data regarding the biosimilar market in Paraguay. In 2011, Paraguay had a Total Pharmaceutical Expenditure of US$445 million, of which US$248 million was private expenditure [28]. In 2016, an agreement was signed between the Argentinian pharmaceutical laboratory Biosidus and Lasca for the production of recombinant human erythropoietin [28]. This alliance accelerates Paraguay’s plans for expansion and capture of new markets in high-tech medicines. Although the alliance was completed, no information about sales or product catalogues could be identified.

Uruguay

Only limited accurate data on the biosimilars market in Uruguay were found. However, in 2015 a reference guide for the control of these products was established. This guide states that it would be necessary to implement strategies to support the training of personnel, promote investments in R & D and update the legal framework in order to boost the biologicals market in Uruguay [42].

Venezuela

The Bolivarian Republic of Venezuela is part of the Mercosur trade bloc, however, in 2019 it was suspended from all the rights and obligations inherent in its statehood. This situation and the economic crisis that currently affects the country has caused local manufacturers, who once generated advanced chemical products, to cease production. There is consequently a lack of access to medicines in Venezuela and only those centres able to import medicines are distributing biosimilars (and even then, at low levels).

The current situation related to the local production of biosimilars in Venezuela is not particularly promising, and currently there are no records regarding the pharmaceutical industry or biosimilars commercialized in the country available [43]. The agency which regulates biosimilar medicines in Venezuela is the Ministry of the Popular Power for Health – National Institute of Hygiene ‘Rafael Rangel’; however, there is no information available regarding current regulation of biosimilars in the country.

Central America and the Caribbean: Costa Rica and Cuba

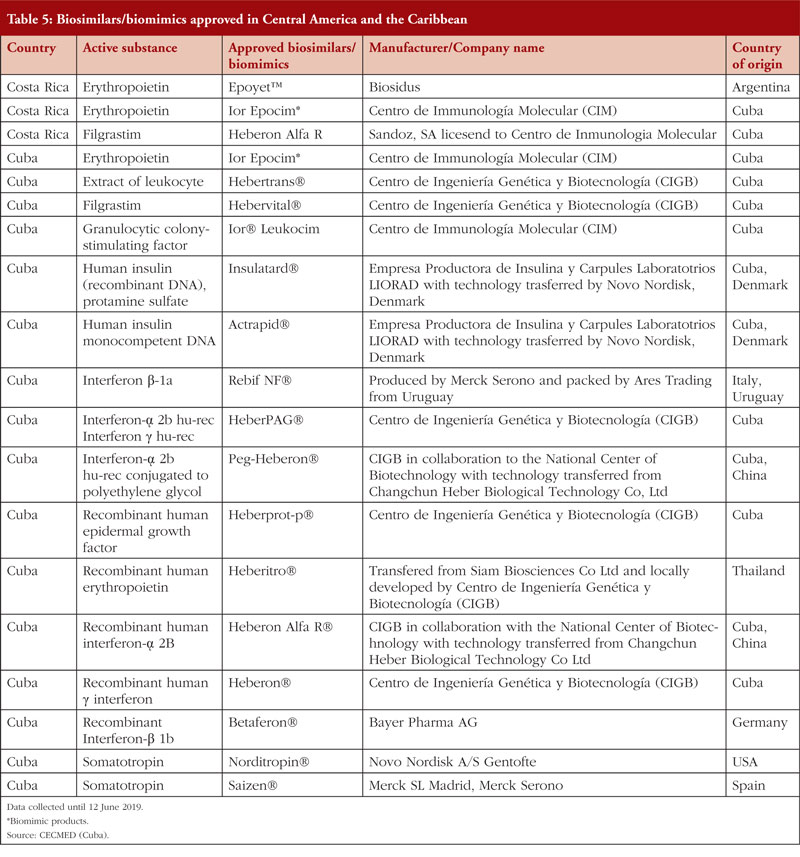

Several countries in Central America like Guatemala and Panama have legislation for the approval of biological and biosimilar products, [44, 45]. Others, such as El Salvador, have no specific regulation for biosimilars. However, the Salvadorian National Direction of Medicines published a statute for the recognition of foreign medicines regulatory agencies. This statue approves the use of drugs that have been registered in countries that fulfil the Pan American Health Organization (PAHO) accreditation process (Level IV certification) [46]. Table 5 provides a list of biosimilars/biomimics approved in Costa Rica and Cuba.

Costa Rica

Costa Rica

In 2010, the Ministry of Health in Costa Rica issued RTCR 440: 2010 – Regulation on the enrolment and control of biological medications [17]. In 2015, the Costa Rican Social Security Fund made the most significant economic investment in purchases of biological drugs in the country’s history, which accounted for over 48% of total investment in medicines (equivalent to approximately US$24 million). The most expensive medicines that were purchased were anti-neoplastic and immunomodulatory drugs [47].

Cuba

In 2011, the Ministry of Public Health in Cuba issued Resolution number 56/2011: requirements for the registration of biological products [48]. This resolution stimulated growth in the biotechnology industry due to investments made by the State and by independent investors, as well as the creation of government-owned pharmaceutical company BioCubaFarma. In 2010, Cuba had a trade balance in the pharmaceutical sector of US$303,606,000 in raw materials [48]. Regarding exports in biopharmaceutical products, the country reached US$686 million in 2013 [49].

Summary

A summary of the approved biosimilars in each of the countries discussed in this manuscript is shown in Tables 1–5. Although most Latin American countries have their own regulations on biosimilars, there are two relevant international trade agreements: the Andean Community of Nations (Comunidad Andina de Naciones, CAN), which relates to countries in the Andean region (Bolivia, Chile, Colombia, Ecuador and Perú); and the Southern Common Market (Mercado Común del Sur, MERCOSUR), which relates to Argentina, Brazil, Paraguay, Uruguay and Venezuela. Both agreements aim to regulate the use of patents in terms of medicines and to control, in someway, the price of medicines in the region. [50, 51].

The most important aspect of these trade agreements lies in the possibility of single consolidated purchases, allowing countries with weaker economies to benefit from greater bargaining power, however, this has so far not been achieved. This means countries must negotiate individually, thus buying at higher prices.

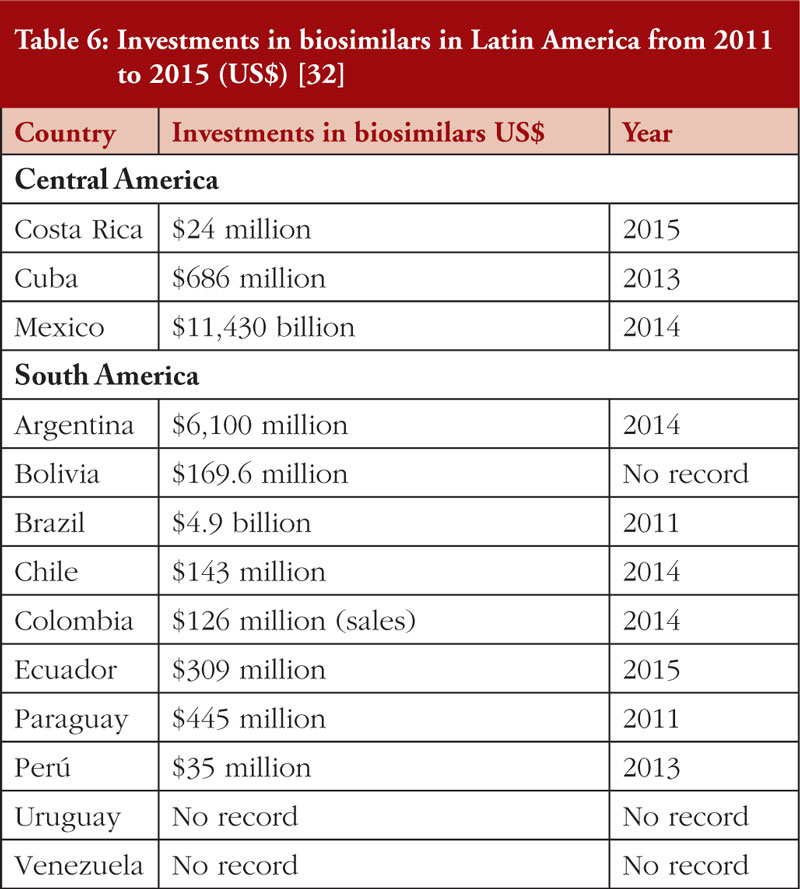

Investment in biosimilars in Latin American countries is increasing year on year, see Table 6 and regulatory authorities in many Latin American countries have been redesigned and standardized for the approval of biosimilars. However, local regulations vary between country.

Discussion

Biosimilars have revolutionized the global pharmaceutical market by increasing competition and driving down prices, however, difficulties have arisen in the path to commercialization. As it can be assumed that a biosimilar has the similar clinical performance as the innovator drug, and at reduced cost, the biosimilar should in principle always win against the innovator product. However, this is not always the case and in many parts of Latin America, patient access to biosimilars remains limited [52]. Although it is a requirement for a biosimilar to have the similar clinical performance as the innovator product, this is not demonstrable for some biosimilars in Latin America. This is because comparability exercises are not mandatory in the region, allowing many products to enter countries only with a list of homologated documents, a situation that may reduce patient trust in biosimilars.

Economic context, drug markets and marketing strategies vary among countries in Latin America. The availability of information on the market size and the volume of import/export are often lacking, whilst Brazil and Argentina generally will have more information available[13].

In terms of biosimilar availability, three main groups of countries in the Americas were identified. The first group includes countries with biosimilars markets that are continuously growing and have fewer barriers to market and commercialize biosimilars. These countries are Argentina, Brazil, Chile, Costa Rica, Colombia, Mexico and Perú. Of particular significance are Argentina, Brazil and Mexico, as these countries are manufacturers of biological products and therefore play a pivotal role in providing access to biosimilars in the region.

The second group of countries (Bolivia, Ecuador, Paraguay and Uruguay) have smaller markets that attract less investment from pharmaceutical companies, which in turn reduces access to biosimilars. These countries are consumers and exporters of biological products on a small scale and play a secondary role in the biosimilars market [45].

The final group of countries may be considered atypical due to their political situation; this includes Cuba and Venezuela. Due to the fact they have been forced to close commercial borders with the US and most of its allies, price variability and the lack of access to biosimilars are not uncommon [53].

Hurdles to biosimilar success vary among countries, but a number of common issues were identified. It is important to distinguish countries with advanced technical capabilities and mature markets from those in the development stages. The first group of countries may be in a more favourable position to increase patient access to biosimilars; however, market structure in these countries still favours innovator drugs. In this context, small biotechnology companies cannot compete against the big pharmaceutical companies. This occurs in Argentina and Brazil for example [54]. In addition, in countries like Colombia and Ecuador, prescribers often receive gifts, trips and other benefits from the pharmaceutical industry, which can lead to unethical prescribing, a situation that is very poorly controlled in the region [32].

Latin American countries have an unmet need for biological products at low prices. The main actors in these countries are government regulatory agencies and public healthcare providers. Some countries such as Argentina, Brazil, Cuba and Mexico have efficient procedures and incentives to enhance patient access to biosimilars; whilst others have not yet developed regulatory systems for biosimilars.

Most countries are working to decrease their expenditure related to drugs. However, this is more difficult in Latin America as the market is fragmented and only the larger countries, such as Argentina and Brazil, are attractive to international suppliers of biosimilars. These leading countries therefore determine the timing of biosimilars manufacturing and commercialization in the region.

The purpose of this literature review is to provide an overview of the current state of the biosimilars market in Latin America. Further analysis is required to identify trends in the commercialization of biosimilars in this region. However, we have identified a number of recommendations. To ensure a promising future for the region, Latin American governments should develop robust regulation for biosimilars. They must also strengthen the capacity of their regulatory agencies to assess biosimilar candidates and perform post-market pharmacovigilance on these approved biosimilar products, allowing the timely assessment of effectiveness and identification of adverse effects.

Conclusions

This literature review shows that information regarding the biosimilars market in Latin America is scarce. It appears that the majority of countries in the region have limited experience in the production of biological drugs. The region in general relies on imported products from North America, Europe and Asia. The future of the biosimilars market in the region will depend on the political and economic will of government, as well as private industry, to support the creation of biotechnology hubs in the region. The development of robust guidelines and regulation regarding the development of biological medicines would also benefit the region.

Competing interests: Dr Esteban Ortiz-Prado worked for Enfarma EP, a government-funded pharmaceutical company in Ecuador. This company was shut down in 2016 and manufactured no generic drugs during 2009-2016. The author declares that none of the comments made in this manuscript have been influenced by his employment at Enfarma EP. The remaining authors declare no conflicts of interest.

Provenance and peer review: Not commissioned; externally peer reviewed.

Authors

Esteban Ortiz-Prado1,2, MD, MSc, MPH, PhD

Jorge Ponce-Zea3, MSc

Jorge E Vasconez1, MD

Diana Castillo1, MD

Diana C Checa-Jaramillo1, MD

Nathalia1, MD

Felipe Andrade2, MD

Damaris P Intriago-Baldeón4, MSc

Claudio Galarza-Maldonado5, MD, PhD

1One Health Research Group, Faculty of Health Sciences, Medical School, Universidad de las Americas, Av. de los Granados E12-41y Colimes esq, Quito 170125 Ecuador

2Department of Cell Biology, Physiology and Immunology, Universidad de Barcelona, Barcelona, Spain

3Universidad Estatal del Sur de Manabí, Manabí, Ecuador

4Universidad Internacional SEK, Quito, Ecuador

5Unidad de Enfermedades Reumaticas y Autoinmunes, Hospital Monte SinaÃ, 6-11 Miguel Cordero Dávila, Cuenca 10107, Ecuador

References

1. Global biologics market size, market share, application analysis, regional outlook, growth trends, key players, competitive strategies and forecasts, 2018 to 2026. Facts, regulations and evolution. [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.researchandmarkets.com/reports/4564281/global-biologics-market-size-market-share

2. Jacoby R SE Wilkins D, Iyer D, Peltre S. Winning with biosimilars. Opportunities in global markets. Deloitte. 2015.

3. Chen Y, Dikan J, Heller J, Santos da Silva J. The biosimilars market: five things you need to know. July 2018. McKinsey.

4. Derbyshire M. Patent expiry dates for biologicals: 2018 update. Generics Biosimilars Initiative Journal. 2019;8(1):24-31. doi:10.5639/gabij.2019.0801.003

5. GaBI Online – Generics and Biosimilars Initiative. WHO definitions of biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Apr 10]. Available from: www.gabionline.net/Biosimilars/General/WHO-definitions-of-biosimilars

6. Danese S, Gomollon F. ECCO position statement: The use of biosimilar medicines in the treatment of inflammatory bowel disease (IBD). J Crohns Colitis. 2013 Aug 1;7(7):586–9.

7 GaBI Online – Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Apr 10]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

8 GaBI Online – Generics and Biosimilars Initiative. Biosimilars approved in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2020 Apr 10]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-the-US

9. Blackstone EA, Joseph PF. The economics of biosimilars. Am Health Drug Benefits. 2013;6:469-78.

10. Belloni A, Morgan D, Paris V. Pharmaceutical expenditure and policies: past trends and future challenges. 2016. OECD Health Working Papers, No. 87, OECD Publishing, Paris.

11. Wouters OJ, McKee M, Luyten J. Estimated research and development investment needed to bring a new medicine to market, 2009-2018. JAMA. 2020;323(9):844-53.

12. Pharma leader series: 25 Top biosimilar drug manufacturers 2016-2026. Visiongain. Available from: https://www.visiongain.com/report/pharma-leader-series-25-top-biosimilar-drug-manufacturers-2016-2026/

13. Gautam A. Market watch: strategies for biosimilars in emerging markets. Nat Rev Drug Dis. 2017;16(8):520-1.

14. Bas T. Biosimilars in two developing economies of South America (Argentina and Brazil) and one developed economy of Oceania (Australia). Facts, regulations and evolution. Res J Pharm Biol Chem Sci. 2016;7(5):1794-809.

15. Azevedo VF, Babini A, Caballero-Uribe CV, Castañeda-Hernández G, Borlenghi C, Jones HE. Practical guidance on biosimilars, with a focus on Latin America: what do rheumatologists need to know? J Clin Rheumatol. 2019;25(2):91-100.

16. Grant MJ, Booth A. A typology of reviews: an analysis of 14 review types and associated methodologies. Health Inf Libr J. 2009;26(2):91-108.

17. Garcia R, Araujo DV. The regulation of biosimilars in Latin America. Curr Rheumatol Rep. 2016;18(3):16.

18. Abrutzky R, Bramuglia C, Godio C. El perfil de la industria farmacéutica de la Argentina: interrogantes a mediano plazo. Cienc Docencia Tecnol. 2015;26(51):102-30.

19. Belló M, Becerril-Montekio VM. Sistema de salud de Argentina. Salud Pública México. 2011;53:s96-s109.

20. Sanchez M, Cano M. La industria farmacéutica argentina: presente y perspectivas. KPMG. Available from: https://assets.kpmg/content/dam/kpmg/pdf/2014/12/La-industria-farmaceutica-argentina-presente-y-perspectivas.pdf

21. Bas T. Research Journal of Pharmaceutical, Biological and Chemical Sciences. Biosimilars in two developing economies of South America (Argentina and Brazil) and one developed economy of Oceania (Australia) Facts, regulations and evolution. 2016;7(5):1798.

22. infobae. Una planta argentina lidera la producción de medicamentos biotecnológicos contra el cáncer en América Latina. 2017 [cited 2020 May 14]. Available from: https://www.infobae.com/espacio-no-editorial/2017/05/01/una-planta-argentina-lidera-la-produccion-de-medicamentos-biotecnologicos-contra-el-cancer-en-america-latina/

23. Anaya J-M, Caro-Moreno J, Enciso-Zuluaga M, Desanvicenter-Celis Z. Similar biotherapeutic products in Latin America. Regulation and opportunities for patients with autoimmune diseases. Biosimilars. 2013;1.

24. Basso AMM, Grossi de Sà MF, Pelegrini PB. Biopharmaceutical and biosimilar products in Brazil: from political to biotechnological overview. J Bioequivalence Bioavailab. 2013;5(1):60-6.

25. Agência Nacional de Vigilância Sanitária. Resolução da diretoria colegiada. 2010 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: http://portal.anvisa.gov.br/legislacao#/visualizar/28623

26. Christain LS. Mexico retoma un liderazgo regulatorio sobre medicamentos biotecnológicos y biocomparables. Gac Med Mex. 2012;148:83-90.

27. Informe Jorge Morales. Evaluación de proveedores multidimensional y desarrollo de proveedor para sistema contenedor cierre [thesis]. Ciudad Universitaria, Cd. Mx. Universidad Nacional Autónoma De México. 2018 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: http://www.ptolomeo.unam.mx:8080/xmlui/bitstream/handle/132.248.52.100/15215/Informe%20Jorge%20Morales.pdf?sequence=4

28. Desanvicente Z, Moreno J, Enciso M, Anaya J. Similar biotherapeutic products in Latin America Regulation and opportunities for patients with autoimmune diseases. Dove Medical Press. 2013;(3):1-17.

29. Bernal-Camargo DR, Gaitán-Bohórquez JC, León-Robayo ÉI. Medicamentos biosimilares en Colombia: una revisión desde el consumo informado. Rev Cienc Salud. 2018;16(2):311-39.

30. Guzmán Ramírez GM, Ramírez Campos MA, Delgado Montero CA. Revisión del uso de los medicamentos biosimilares vs. biológicos: implicaciones para la salud en Colombia. 2016.

31. Regulación AN de C y VS-M. Resolución ARCSA-DE-009-2018-JCGO. 2018 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://drive.google.com/file/d/166rttFA-jAlNurRGWPn10LaiUmMLa8LU/view

32. Ortiz-Prado E. El mercado farmacéutico ecuatoriano. 1st ed. Vol. 1. Quito, Ecuador: UDLA Ediciones; 2018 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.researchgate.net/publication/334899184_El_mercado_farmaceutico_ecuatoriano_Autor_y_editor_Esteban_Ortiz-Prado_Coeditores

33. Ministerio de Salud Pública. Precios de Medicamentos_Consejo Nacional de Fijación y Revisión de Precios de Medicamentos de Uso y Consumo Humano [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.salud.gob.ec/precios-de-medicamentos_-consejo-nacional-de-fijacion-y-revision-de-precios-de-medicamentos-de-uso-y-consumo-humano/

34. Asociación Española de Biosimilares. Medicamentos biosimilares aprobados por la Comisión Europea. 2018 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.biosim.es/medicamentos-biosimilares-aprobados-por-la-comision-europea/

35. Ortiz-Prado E, Galarza-Maldonado C, Cornejo, Ponce J. Acceso a medicamentos y mercado farmacéutico en Ecuador. Rev Panam Salud Pública. 2014;36:(1):57-62.

36. Ortiz-Prado E, Cevallos-Sierra G, Teran E, Vasconez E, Borrero-Maldonado D, Ponce Zea J, et al. Drug prices and trends before and after requesting compulsory licenses: The Ecuadorian experience. Expert Opin Ther Pat. 2019;29(8):653-62.

37. Ministerio de Salud Perú.Beteta Obreros E. Evaluación del potencial impacto de medidas de protección de la propiedad intelectual en el acceso a productos biológicos. 2015 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://docplayer.es/19020227-Evaluacion-del-potencial-impacto-de-medidas-de-proteccion-de-la-propiedad-intelectual-en-el-acceso-a-productos-biologicos.html

38. Ministerio de Salud. Direccion General de Medicamentos, Insumos y Drogas Drogas. Situación de los productos oncológicos de mayor impacto económico en el sistema de salud. 2015.

39. Instituto de Salud Pública. Subdepartamento de Registro: Biotecnológico [homepage on the Internet]. [cited 2020 Apr 10]. Available from: http://www.ispch.cl/anamed/subdeptoregistro/seccion_productos_nuevos/biotecnologicos

40. Instituto de Salud Pública. Norma técnica de registro sanitario de productos biotecnológicos derivados de técnicas de ADN recombinante [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.minsal.cl/sites/default/files/files/REGISTRO SANITARIO DE PRODUCTOS.pdf

41. Embassy of India, Santiago. Chile pharmaceutical market survey. Commissioned from Ms Carmen Gloria Fuentealba on behalf of the Economic Diplomacy Division. Ministry of External Affairs [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.indianembassysantiago.gov.in/pdf/PHARMACEUTICAL%20MARKET%20SURVEY%202-1.pdf

42. IMPO. Decreto N° 38/015. 2015 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.impo.com.uy/bases/decretos-originales/38-2015

43. Azevedo VF, Sandorff E, Siemak B, Halbert RJ. Potential regulatory and commercial environment for biosimilars in Latin America. Value Health Reg Issues. 2012;1(2):228-34.

44. ALIFAR. Socual M de SP y A. Norma Técnica 67/2015. 2015 [homepage on the Internet]. [cited 2020 Apr 14]. Available from: http://www.alifar.org/posts/index/1107/name:Guatemala-Norma-tecnica-67-2015

45. Azevedo VF, Mysler E, Álvarez AA, Hughes J, Flores-Murrieta FJ, Ruiz de Castilla EM. Recomendaciones para la reglamentación de biosimilares y su implementación en Latinoamérica. Generics and Biosimilars Initiative Journal (GaBI Journal). 2014;3(3):143-8, doi:10.5639/gabij.2014.0303.032

46. Beltrán A, Guadalupe K, Cardoza VA. Diseño de una propuesta de lineamientos para una reglamentación de registro de medicamentos biosimilares en San Salvador. Universidad de El Salvador. 2018 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: http://ri.ues.edu.sv/id/eprint/16144/

47. Cambronero A, Coto R, Molina J, Mora Román JJ. Oferta de medicamentos biosimilares a la Caja Costarricense de Seguro Social: posible impacto económico para la seguridad social. Revista médica de la Universidad de Costa Rica. 2017;11(1):22-36.

48. Jover JN, Alfonso GF. Biotecnología y sociedad en Cuba: el caso del Centro de Inmunología Molecular. Rev Trilogía. 2014;(10):11-24.

49. World Health Organization. Cuban experience with local production of medicines, technology transfer and improving access to health. 2015 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.who.int/phi/publications/Cuba_case_study121115.pdf

50. Secretaría General de la Comunidad Andina. Comunidad Andina [homepage on the Internet]. [cited 2020 Apr 10]. Available from: http://www.comunidadandina.org/index.aspx

51. MERCOSUR [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.mercosur.int/

52. Organización Panamericana de la Salud. Recomendaciones para la evaluación de productos bioterapéuticos similares (PBS). 2011 [homepage on the Internet]. [cited 2020 Apr 10]. Available from: https://www.paho.org/hq/index.php?option=com_content&view=article&id=5701:vi-conferencia-documentos-tecnicos-adoptados&Itemid=41775&lang=es

53. Kuntz D, Jackson C. The politics of suffering: the impact of the U.S. embargo on the health of the Cuban people. Report to the American Public Health Association of a fact-finding trip to Cuba, June 6-11, 1993. J Public Health Policy. 1994;15(1):86-107.

54. Morgan MA, Dana J, Loewenstein G, Zinberg S, Schulkin J. Interactions of doctors with the pharmaceutical industry. J Med Ethics. 2006;32(10):559-63.

|

Author for correspondence: Esteban Ortiz-Prado, MD, MSc, MPH, PhD, One Health Research Group, Faculty of Health Sciences, Medical School, Universidad de las Americas, Av. de los Granados E12-41y Colimes esq, Quito 170125, Ecuador |

Disclosure of Conflict of Interest Statement is available upon request.

Copyright © 2020 Pro Pharma Communications International

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Good afternoon, an observation I am a co-author and my name in the part of authors is wrong, I am Diana C Checa Jaramillo. However at the end of the article that they put my name again is fine. They could correct the Jaramilloz by Jaramillo. Thank you.

I am interested in obtaining the full version of this article. Can you guide me please? I don´t see any PDF or full version button here. Thank you.

Dear Diana Checa Jaramillo,

We very much appreciate your kind feedback. We have updated your name to Jaramillo. We apologize for any inconvenience caused.

Thank you for your interest in GaBI. Please enjoy the quality information and content published under GaBI (GaBI Online and GaBI Journal).

GaBI Journal Editorial Office

Dear Paola Sevilla

We very much appreciate your kind feedback. The figures, tables and references are available on the website article and can be printed in PDF format.

Thank you for your interest in GaBI. Please enjoy the quality information and content published under GaBI (GaBI Online and GaBI Journal).

GaBI Journal Editorial Office