Budget impact analysis of a rituximab intravenous biosimilar in patients with follicular lymphoma and large B-cell non-Hodgkin lymphoma in Chile

Published on 2024/03/21

Generics and Biosimilars Initiative Journal (GaBI Journal). 2024;13(1):4-13.

Author byline as per print journal: Tomás Abbot1, MSc; Nicolás Armijo1, MSc; Robin Piron2, PhD; Manuel Espinoza1,3, PhD

|

Introduction: In Chile, access disparities and budget constraints affect the treatment of non-Hodgkin lymphoma patients, even though therapies like rituximab are covered by the Regime of Explicit Health Guarantees. Biosimilars like Rixathon® off er a compelling alternative with similar efficacy at lower cost. This study conducted a budget impact analysis to assess the introduction of Rixathon® for follicular lymphoma (FL) and diff use large B-cell non-Hodgkin lymphoma (DLBCL) patients from Chilean healthcare system perspective. |

Submitted: 5 December 2023; Revised: 19 February 2024; Accepted: 26 February 2024; Published online first: 4 March 2024

Introduction

Non-Hodgkin lymphoma (NHL) is the 11th most common cancer diagnosis and the 11th leading cause of cancer death in the world [1]. The frequency of NHL subtypes varies by region, with about 85% B-cell lymphomas and 15% T-cell lymphomas in western countries [2, 3]. Diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma (FL) are the most common non-Hodgkin lymphomas, accounting for 30% and 20% of all lymphomas reported in high-income countries, respectively [4, 5].

The treatment of these lymphomas will depend on the stage in which the patient is. The early stages usually do not require systemic therapy and, therefore, are treated by radiotherapy. Whereas, the advanced stages are treated with rituximab-based immunochemotherapy [6].

In Chile, treatment for both DLBCL and FL is covered by the public healthcare system through the Garantias Explicitas en Salud, GES mechanism (Regime of Explicit Health Guarantees). Patients can access immunochemotherapy such as rituximab-CHOP (cyclophosphamide, doxorubicin, vincristine and prednisone) and rituximab-COP (cyclophosphamide, vincristine and prednisone) [7]. In addition, patients eligible for high-cost oncologic drugs funding are treated with rituximab-bendamustine [8].

Rituximab is presented as an important treatment option in several guidelines both in cancer and rheumatology [9]. Despite this, the potential impact of biological therapies is often diminished in clinical practice because of inequalities in patient access, where budget constraints and cost-related barriers are key factors [9]. The approval of biosimilars of monoclonal antibodies represents a significant economic opportunity to health authorities worldwide as these molecules will generate price reduction and consequently will reduce the overall cost of biological therapy [10]. In Chile, rituximab biosimilars such as Rixathon® and Truxima® have entered in the Chilean market in 2019 [11].

Rixathon® is a biosimilar approved in Chile, the European Union and other highly regulated markets for use in all indications of reference rituximab [11, 12]. Since it represents therapeutic equivalence at a potential lower cost, there is a need to evaluate the budget impact associated with Rixathon® coverage in the Chilean health system. This study aimed to perform a budget impact analysis of the introduction of the intravenous biosimilar Rixathon® in patients with FL and large B-cell non-Hodgkin lymphoma (BCNHL) from the Chilean health system perspective.

Methods

Model structure

We developed a budget impact model in the Microsoft Excel platform to estimate cumulative costs and savings with the introduction of Rixathon® in the Chilean healthcare system. An expected cohort of DLBCL and FL patients were modelled. The budget impact analysis (BIA) was developed according to the recommendations proposed by the International Society for Pharmacoeconomics and Outcomes Research’s principles of good practice for BIAs [13].

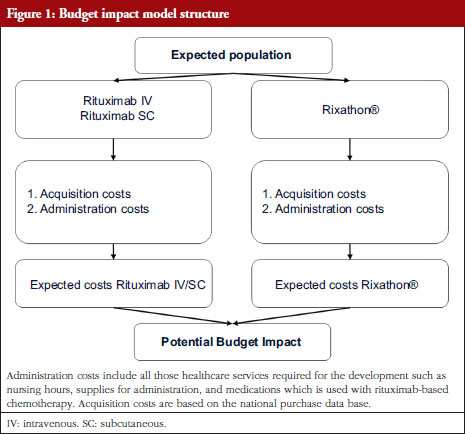

In brief, an estimation of the eligible population was performed to calculate the expected cost attributable to DLBCL and FL management. For this cost estimate, two dimensions were considered: acquisition costs and administration costs. The BIA corresponds to the cost’s differences between the projected scenario (considering Rixathon®) and the actual scenario, see Figure 1.

Perspective and time horizon

The context of this analysis is the eventual incorporation of the biosimilar alternative Rixathon® for patients with DLBCL and FL, within the therapies available in the GES. Therefore, the analysis is done from the Chilean healthcare system’s perspective. The BIA was conducted over a 5-year time horizon (2023–2027).

Eligible population

For the eligible population estimation, a bottom-up approach was used based on rituximab units’ purchases by the Chilean public health system. This approach relies on the database that includes all tenders carried out at the public health system level that involve rituximab during the years 2015–2023. It should be noted that the tenders contained may or may not be mediated by Central de Abastecimiento del Sistema Nacional de Servicios de Salud, CENABAST (Central Supply of the National Health Services System), because there are tenders carried out directly by hospitals. This database that was obtained through formal public request, which is legally entitled by law, serve as the basis for estimating the number of individuals with both FL and DLBCL.

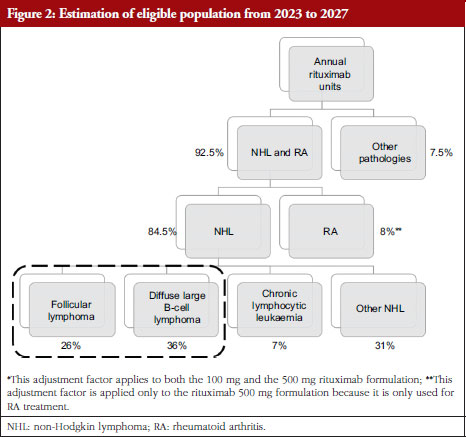

This approach estimates the number of individuals with FL and DLBCL based on the ratio between the milligrams of rituximab indicated annually for each pathology, and its expected dosage regimen [14]. Therefore, using the total amount of rituximab, adjustment factors – weighting multipliers systematically applied – were utilized which reflects the alternative use of rituximab in other pathologies. The bottom-up approach is presented in Figure 2.

For the public and private health system, the same distribution of the rituximab indication was assumed. Thus, the private rituximab amount was estimated by adjusting the milligram reported for the public health system with the relative weight of each subsystem: 17% private and 80% public [15]. In consequence, private rituximab milligrams correspond to 21% of those reported for the public health system. This estimation was done to calculate the number of milligrams marketed in the base year (2022). These estimates are presented in Appendix A.

To define the rituximab utilization between NHL and rheumatoid arthritis (RA), 7.5% of the total units was assumed to be used in other indications (renal disease, multiple sclerosis, off-label uses). This assumption is coherent with the judgement of experts, specifically physicians with more than 10 years of experience in oncology and academic background in this field. The information was gathered through a meeting and a survey with the selected experts in order to validate the model and its assumptions. They indicated that below 8% of rituximab proportion is used for other pathologies. It is important to highlight that this adjustment factor is applied only to the 100 mg and 500 mg presentation, since the 1,400 mg presentation its exclusively used for NHL [16].

Furthermore, all purchases made with funds from the high-cost drug scheme were used to estimate the units and milligrams indicated for RA [17]. This funding scheme is used exclusively to access rituximab treatment for RA. According to this database, 439,839 rituximab milligrams are allocated to RA, which represents 8.08% of the total mg registered for rituximab 500 mg (the formulation used for RA) [16].

Since no information regarding specific rituximab utilization for each pathology was available, it was assumed that rituximab shares will be distributed according to the relative proportions of each pathology among NHLs where rituximab is indicated. Therefore, T-cell NHLs were excluded, which represent about 15% of NHLs. Finally, the milligrams estimation for rituximab in the i-th pathology is detailed in Appendix B.

To report the individuals treated in subsequent years, a growth rate of 1.16%, which is assumed constant, was applied to the estimated population in the base year. This growth rate was obtained from the population projections reported by the National Institute of Statistics [18].

Comparators and market shares

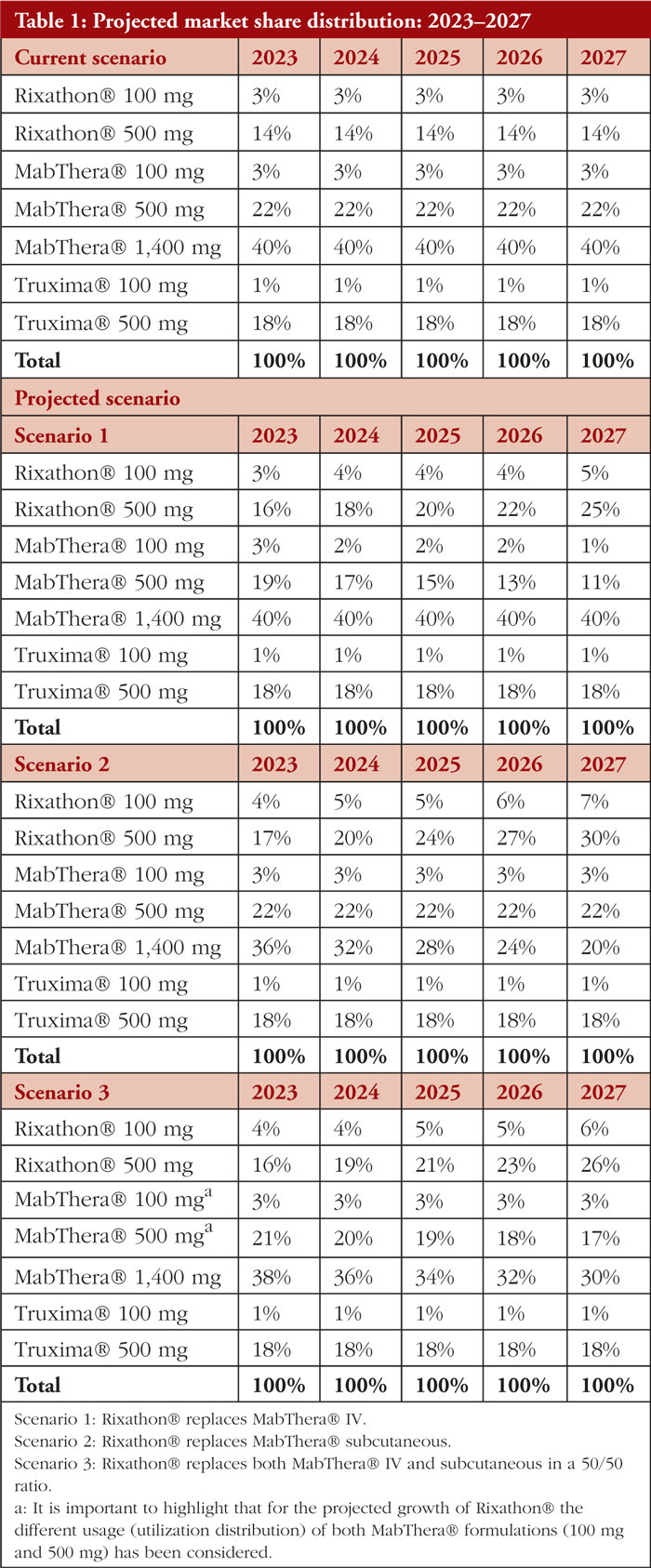

Since our analysis will focus on determining the differences in costs that occur as a direct consequence of Rixathon® coverage, the other biosimilar alternative of rituximab, Truxima® was considered as a comparator. In addition, the innovator MabThera® SC (subcutaneous) and MabThera® IV (intravenous) administration formulations were also considered. In all projected scenarios, the increase in the inclusion of Rixathon® was attributed to the declining market share of MabThera®.

The market shares used for the current scenario were established based on the volume of purchases reported for each alternative with respect to the static total purchases for rituximab incurred during the year 2017 extended to 2023. The current scenario refers to the market partition currently present at the health system level, it does not consider an aggressive entry by the technology of interest (Rixathon®).

Regarding the projected scenario, three scenarios are proposed, in which the growth of Rixathon® will occur to the detriment of the innovative alternative of rituximab (MabThera®). In the first scenario, the growth of Rixathon® will occur at the expense of MabThera® IV, this scenario is the least conservative among those proposed since the coverage of Rixathon® will be associated only with savings in the treatment dimension (Rixathon® is cheaper and has administration costs equivalent to MabThera® IV). In the second scenario, the most conservative, Rixathon® will displace MabThera® SC, which will cause savings in treatments, but incremental costs in the administration dimension – SC administration is less expensive than IV administration. Finally, the third scenario to be evaluated corresponds to a combination of the first two scenarios, with Rixathon® replacing MabThera® IV and MabThera® SC – in a 50/50 ratio. The actual and projected scenarios are presented in Table 1.

Given that the 500 mg MabThera® formulation is predominately used, the decrease in its market share due to the entry of Rixathon is thus more noticeable than that of MabThera® 100 mg.

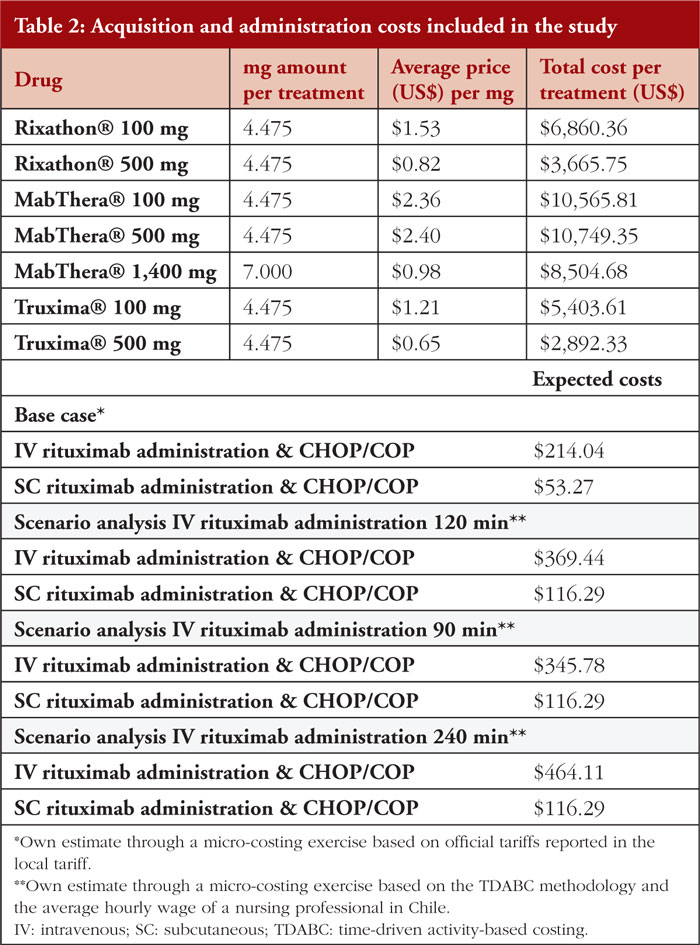

Costs

Acquisition and administration costs were included as presented in Figure 1. Treatment costs were obtained directly from a database that contains tenders regarding rituximab purchases. Regarding the length of rituximab treatment and the potential for discontinuation, our assumption is that all patients successfully complete their therapy. An average cost was estimated between 2017–2023 for each comparator in this analysis, see Table 2. Regarding administration costs, we built baskets that contain the entire process required to administer rituximab. As a benchmark, we used the healthcare costing study of the Ministry of Health [19]. It should be noted that the administration time is not considered within this costing approach. This is because the Chilean tariffs are not expressed in function of the time spent per procedure. Finally, the costs are reported in USD as of July 2023 (1 USD = 813.4 Chilean Peso [CLP]).

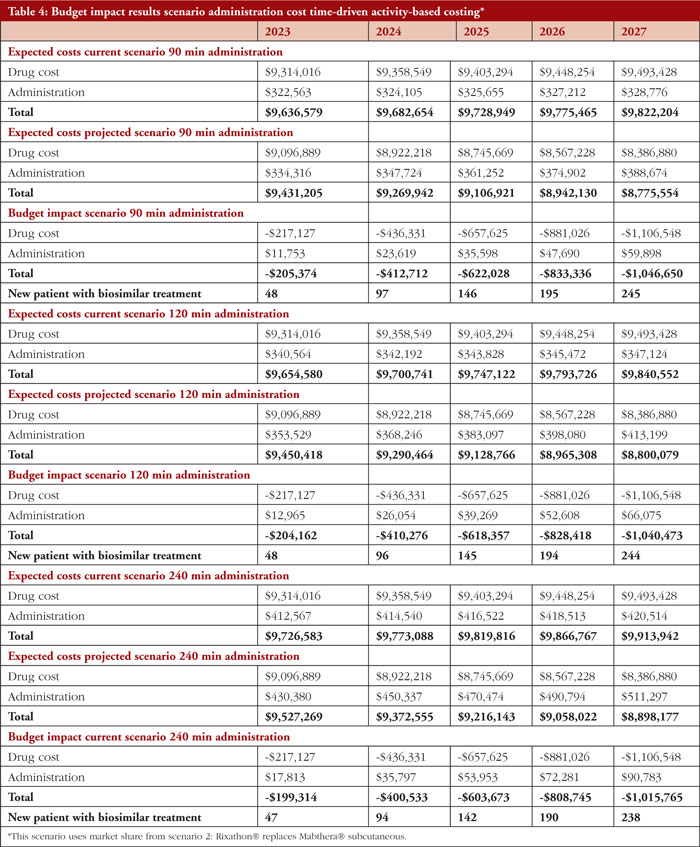

To determine the impact of differences in administration time, an additional approach was used. Here, time-driven activity-based costing (TDABC) was applied which estimates the expected cost of a given activity as the product between the cost of executing that activity per minute and the number of minutes used to perform that activity [20]. We used the estimates of employability and salaries reported by the Chilean Ministry of Education to value the hourly wage of a nursing professional [21]. Since no official source was found that reports the unit cost of an oncology administration chair per use or unit of time, the total daily cost of an ambulatory bed was used to conservatively reflect this expense. This approximation is in line with that reported by official costing exercises commissioned by the Chilean Ministry of Health [21].

Results

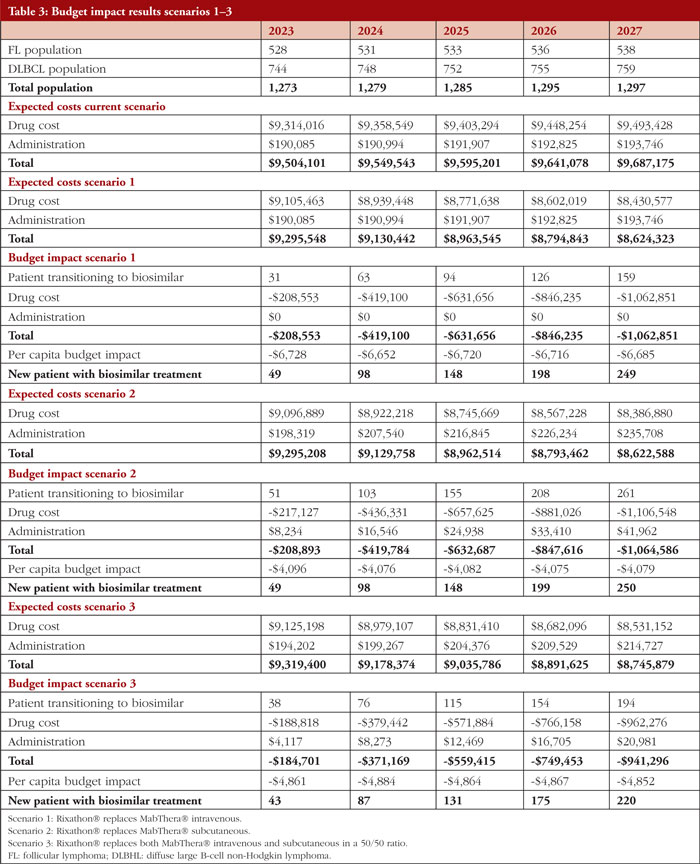

The main findings are presented in Table 3. The population is projected to increase from 1,274 individuals in the first year to 1,297 in year fifth, of which 41% represents patients with FL and 59% patients with DLBCL. In the scenario considering market share 1, Rixathon® increases at the expense of MabThera® IV. For 2023, we expect the health system has an estimated expenditure of US$9,504,101 while it would incur in an expenditure of US$9,295,548 to provide greater coverage to Rixathon®. This translates into a net saving of US$208,553 which is explained by the lower cost of the primary treatment. These savings would allow 49 additional patients to benefit from Rixathon®. Alternatively, this corresponds to a net saving of US$669,094 per 100 patients treated with Rixathon® (or US $6,691 per capita). The additional growth in savings during the following years further reflects the continued increase in Rixathon® market share.

In the second scenario considering market share 2, Rixathon® increases at the expense of MabThera® SC. The health system incurs in the same Rixathon expenditure for year 1 as in scenario 1, i.e. US$9,295,208. This translates into a net savings of US$208,893, which is explained by a lower cost of drug acquisition combined with an increment in administration cost that is minimal (or US$4,096 per capita taking into account that 51 patients transition to the biosimilar in this scenario). In addition, the scenario 3 considers a Rixathon® expenditure of US$9,319,400 which results in net savings of US$185,701 in 2023 (or US$4,861 per capita given that 38 patients transition to the biosimilar).

Table 4 presents a breakdown of the net budget impact considering the TDABC administration cost approach. Here, the market share from the scenario 2 analysis was used (increased Rixathon market share in detriment of that of MabThera SC). This shows that for year 1 the expected costs are between US$9,636,579 to US$9,527,269, depending on the duration of the administration. Thus, nets savings are in the range of US$205,374 to US$199,314 for the first year followed by an increased growth in annual saving during the years thereafter that again reflects the increased market share of Rixathon.

Discussion

This BIA was developed to estimate the costs in the Chilean healthcare system of the current and several projected scenarios where the market share of Rixathon® varies in the presence of intravenous and subcutaneous reference products over a 5-year time horizon. In particular, the present study considered the trade-off between differences in acquisition and administration costs for subcutaneous and intravenous formulations of rituximab.

Our population estimates were 528 and 744 individuals, for FL and DLBCL, respectively, on treatment with rituximab. The calculation was performed considering commercial rituximab records together with international evidence. This approach was deemed reasonable according to the consulted experts for estimating the number of effective individuals who received chemo-immunotherapy treatment during the 2023 period. In addition, this approach aligns with other budget impact analyses previously reported in the context of biosimilars [22, 23].

To our knowledge, this is the first budget impact in Latin-America that analyses the budget variations resulting from the inclusion of Rixathon® at the expense of the innovator rituximab. Several studies examining the overall budgetary impact of adopting biosimilars support our findings that the substitution of reference rituximab for its biosimilar results in costs savings [9, 23–26]. Additionally, the liberated budget could be used to purchase more Rixathon® and hence benefit more patients. Indeed, other studies in Europe have suggested that the introduction of biosimilars may extend treatment up to an additional 11% of patients in need of MabThera® treatment [9, 27]. Our findings show that in scenario 1 the net savings may extend the treatment for FL and DLBCL up to 2.4% (from 1,273 to 1,304 patients) in 2023, and 10.9% (from 1,297 to 1,456 patients) in 2027. This trend remains similar regardless of the scenario analysis. An important side note is that treatment extensions of course depends on the capacity of the health institution to deal with a larger number of intravenous infusions [23].

Since the same administration route was considered in scenario 1, no additional costs were associated with the inclusion of Rixathon®. Nevertheless, scenario 2 and 3 compared different administration route for rituximab (SC and IV) which results in incremental costs. However, those incremental costs represent between 3.8% and 2.2% of the total budget impact for scenario 2 and 3, respectively. Furthermore, the incremental cost is offset by savings in drug acquisition that allow an additional 43 to 250 new patients to receive Rixathon, respectively, for year 1 and 5 depending on the analysis scenario.

To assay the impact of treatment administration time more precisely, this study included TDABC method. The TDABC method presents an appealing approach due to its capacity to discern and quantify cost disparities stemming from the diverse routes of administration, specifically IV versus SC. These routes diverge in terms of the time expended by the administering healthcare professional, and the time allocated for the utilization of an administration chair. Notably, the scenario involving slow administration, aligning with extended administration times, exhibited diminished cost savings. Indeed, administration costs were twice as expensive as in scenario 2 (US$17,813 TDABC 240 min and US$8,234 scenario 2). This reduction in savings can be attributed to elevated incremental costs incurred in the administration process. Conversely, the scenario involving rapid infusion demonstrated the most substantial cost savings associated with the utilization of Rixathon®. This cost represents 5.41% of the total budget impact which implies an increase of 42% in the administration cost from scenario 2. Although there is a reduction in savings with the TDABC approach, this incremental cost is marginal. Certainly, the total net savings reflect between 92%–95% of the total budget impact, which may extend Rixathon® treatment to an additional 47 to 248 new patients between the first and fifth year, depending on the administration infusion time.

This study also faces some limitations. Price changes for existing therapies were neglected in the study. Prices of existing products might be lowered if competition increases with the entry of other products. It has been reported that the introduction of more competitors in tenders may increase price competition, leading to a potential reduction in tender prices [28, 29]. In Italy, the inclusion of an additional biosimilar competitor was associated with an average price reduction of approximately 10% [30]. Moreover, our research did not consider potential market access agreements, such as discounts on listed prices or alternative risk-sharing arrangements. Consequently, the current calculations of budgetary savings could potentially be inflated, while the projections of expenditure increases might be understated [31]. No vial sharing was considered in our estimation. However, this practice is variable and likely to differ between hospitals [31]. Also, the TDABC estimate did not account for the costs associated with ancillary services such as billing and human resources, because it is not feasible to account for every cost associated with healthcare delivery [32].

Furthermore, the estimates of the target population were obtained through the combination of multiple sources of information and assumptions supported by clinical experts. In this regard, the lack of empirical evidence could introduce some inaccuracy into our estimates. For instance, to inform the fraction of milligrams of rituximab to be used in other conditions (neither NHL nor RA), direct consultation with experts was conducted. Consequently, since we did not have data on rituximab purchases in the private healthcare sector, our model assumed that medication acquisition in the private healthcare system would follow a distribution equivalent to that reported in the public system. While this approach facilitated the estimation of the population with FL and DLBCL, it is essential to acknowledge that this assumption may not be entirely accurate in practice. Variations in the sociodemographic conditions of patients, along with other unaccounted factors, could influence the patterns of medication purchases recorded in the private sector.

Conclusion

This budget impact analysis emphasised that increased used of Rixathon® may result in considerable cost savings from a Chilean health system perspective. Several scenario analyses indicated that the incremental cost in terms of administration is marginal in relation to the net savings. Hence, the variation in administration costs should not be a barrier for the uptake of rituximab biosimilars. Additionally, the budgetary savings would be associated with an increase in patient accessibility to rituximab treatment. This evidence supports that biosimilars represent an interesting alternative to improve the efficiency and sustainability of the Chilean health system and contributes to the broader efforts to improve access to biosimilars in Latin America [33].

Funding sources

This study was funded by Sandoz Chile SpA.

Competing interests: The researchers declare that they have carried out this study within the framework of their salary conditions with the university and in no case have they received specific additional incentives for this study. Mr Tom’s Abbott has received fees from AbbVie and Boehringer Ingelheim for educational services and presentations. Mr Nicol’s Armijo has received fees from Roche and Sandoz for educational services and presentations. Dr Robin Piron is employed by the Sandoz Medical Department without any commercial incentives or other specific incentives for this study. Dr Manuel Espinoza has received fees from Merck, Grunenthal, Boehringer Ingelheim, Novartis, MSD, AbbVie, Roche, for training activities and presentations. The authors have no other relevant affiliations or financial involvement with any organization or entity with a financial interest in or financial conflict with the subject matter or materials discussed in the manuscript apart from those disclosed.

Provenance and peer review: Not commissioned; externally peer reviewed.

Authors

Tom’s Abbot 1, MSc

Nicol’s Armijo 1, MSc

Robin Piron 2, PhD

Manuel Espinoza 1,3, PhD

1Health Technology Assessment Unit, Pontificia Universidad Católica de Chile

2Sandoz Chile

3Deparment of Public Health, Pontificia Universidad Católica de Chile

The data in Appendix A and B that support the findings of this study are available from the editorial office upon reasonable request.

References

1. Luo J, Craver A, Bahl K, Stepniak L, Moore K, King J, et al. Etiology of non-Hodgkin lymphoma: a review from epidemiologic studies. JNCC. 2022;2(4):226-34.

2. Perry AM, Diebold J, Nathwani BN, MacLennan KA, Müller-Hermelink HK, Bast M, et al. Non-Hodgkin lymphoma in the developing world: review of 4539 cases from the International Non-Hodgkin Lymphoma Classification Project. Haematologica. 2016;101(10):1244-50.

3. Polepole P, Mudenda VC, Munsaka SM, Zhang L. Spectrum of common Hodgkin lymphoma and non-Hodgkin lymphomas subtypes in Zambia: a 3-year records review. J Health Popul Nutr. 2021;40(1):37.

4. Singh R, Shaik S, Negi BS, Rajguru JP, Patil PB, Parihar AS, et al. Non-Hodgkin’s lymphoma: a review. J Family Med Prim Care. 2020;9(4):1834-40.

5. Thandra KC, Barsouk A, Saginala K, Padala SA, Barsouk A, Rawla P. Epidemiology of non-Hodgkin’s lymphoma. Med Sci (Basel). 2021;9(1):5.

6. Zelenetz AD, Advani RH, Buadi F, Cabanillas F, Caligiuri MA, Czuczman MS, et al. Non-Hodgkin’s lymphoma. Clinical practice guidelines in oncology. J Natl Compr Canc Netw. 2006;4(3):258-310. Epub 2006/03/02. doi: 10.6004/jnccn.2006.0025. PubMed PMID: 16507273.

7. Ministerio de Salud de Chile. Listado específico de prestaciones. 17. Linfomas en personas de 15 años y más Santiago de Chile: Ministerio de Salud de Chile; 2022 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://auge.minsal.cl/problemasdesalud/lep/17

8. Ministerio de Salud de Chile. Drogas Oncológicas de Alto Costo (DAC) Santiago de Chile: Ministerio de Salud de Chile; 2022 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://www.minsal.cl/drogas-oncologicas-de-alto-costo-dac/

9. Gul’csi L, Brodszky V, Baji P, Rencz F, Péntek M. The rituximab biosimilar CT-P10 in rheumatology and cancer: a budget impact analysis in 28 European countries. Adv Ther. 2017;34(5):1128-44.

10. Almaaytah A. Budget impact analysis of switching to rituximab’s biosimilar in rheumatology and cancer in 13 countries within the Middle East and North Africa. Clinicoecon Outcomes Res. 2020;12:527-34.

11. Instituto de Saluda Pública. Sistema de Consulta de Productos Registrados Santiago de Chile: Instituto de Salud Pública; 2023 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://registrosanitario.ispch.gob.cl/

12. Smolen JS, Cohen SB, Tony H-P, Scheinberg M, Kivitz A, Balanescu A, et al. Efficacy and safety of Sandoz biosimilar rituximab for active rheumatoid arthritis: 52-week results from the randomized controlled ASSIST-RA trial. Rheumatology (Oxford). 2020;60(1):256-62.

13. Sullivan SD, Mauskopf JA, Augustovski F, Jaime Caro J, Lee KM, Minchin M, et al. Budget impact analysis—principles of good practice: report of the ISPOR 2012 Budget Impact Analysis Good Practice II Task Force. Value Health. 2014;17(1):5-14.

14. MINSAL. Problema de salud AUGE N°17. Linfoma No Hodgkin en personas de 15 años y más Ministerio de Salud de Chile: División de Prevención y Control de Enfermedades; 2023 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://diprece.minsal.cl/garantias-explicitas-en-salud-auge-o-ges/guias-de-practica-clinica/linfoma-en-personas-de-15-anos-y-mas/linfoma-no-hodgkin/documentos-relacionados/

15. Fondo Nacional de Salud. Datos abiertos Fonasa Santiago de Chile: Fondo Nacional de Salud; 2023 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://www.fonasa.cl/sites/fonasa/datos-abiertos/tablero-beneficiario

16. European Medicines Agency. Annex 1. Summary of product characteristics European Union: European Medicines Agency [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://www.ema.europa.eu/en/documents/product-information/mabthera-epar-product-information_en.pdf

17. CENABAST. Compras CENABAST Santiago de Chile: Central de Abastecimiento del Sistema Nacional de Servicios de Salud; 2023 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://www.cenabast.cl/compras-cenabast/

18. IHME. Global Burden of Disease: Results Tool. 2019 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: http://ghdx.healthdata.org/gbd-results-tool.

19. DESAL. Ministerio de Salud. Estudio verificación del costo esperado individual promedio por beneficiario del conjunto priorizado de problemas de salud con garantías explícitas 2021. Subsecretaria de Salud Pública. Departamento de Economía de la Salud: Ministerio de Salud de Chile, 2022 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: desal.minsal.cl/publicaciones/apoyo-reforma-ges/

20. Parikh NR, Chang EM, Kishan AU, Kaprealian TB, Steinberg ML, Raldow AC. Time-driven activity-based costing analysis of telemedicine services in radiation oncology. Int J Radiat Oncol Biol Phys. 2020;108(2):430-4.

21. Ministerio de Educación. Empleabilidad e ingresos Ministerio de Educación: Subsecretaría de Educación Superior; 2023 [homepage on the Internet]. [cited 2024 Feb 19]. Available from: https://educacionsuperior.mineduc.cl/empleabilidad-e-ingresos/

22. Boidart A, Darveau M, Déry N, Racine MC. Real-world budget impact of listing a biosimilar of rituximab. Can J Hosp Pharm. 2020;73(1):13-8.

23. Jang M, Simoens S, Kwon T. Budget impact analysis of the introduction of rituximab and trastuzumab intravenous biosimilars to EU-5 markets. BioDrugs. 2021;35(1):89-101.

24. Rognoni C, Bertolani A, Jommi C. Budget impact analysis of rituximab biosimilar in Italy from the hospital and payer perspectives. Glob Reg Health Technol Assess, 2018(5):228424031878428.

25. Calleja MA, Albanell J, Aranda E, García-Foncillas J, Feliu A, Rivera F, et al. Budget impact analysis of bevacizumab biosimilars for cancer treatment in adult patients in Spain. Eur J Hosp Pharm. 2023;30(e1):e40-e47.

26. García-Goñi M, Río-Álvarez I, Carcedo D, Villacampa A. Budget impact analysis of biosimilar products in Spain in the period 2009-2019. Pharmaceuticals (Basel). 2021;14(4):348.

27. Burcombe R, Chan S, Simcock R, Samanta K, Percival F, Barrett-Lee P. Subcutaneous trastuzumab (Herceptin®): a UK time and motion study in comparison with intravenous formulation for the treatment of patients with HER2-positive early breast cancer. Adv Breast Cancer Res. 2013;02(04):133-40.

28. Wouters OJ, Sandberg DM, Pillay A, Kanavos PG. The impact of pharmaceutical tendering on prices and market concentration in South Africa over a 14-year period. Soc Sci Med. 2019;220:362-70.

29. Renwick MJ, Smolina K, Gladstone EJ, Weymann D, Morgan SG. Postmarket policy considerations for biosimilar oncology drugs. Lancet Oncol. 2016;17(1):e31-e-38.

30. Curto S, Ghislandi S, van de Vooren K, Duranti S, Garattini L. Regional tenders on biosimilars in Italy: an empirical analysis of awarded prices. Health Policy. 2014;116(2):182-7.

31. Kanters TA, Stevanovic J, Huys I, Vulto AG, Simoens S. Adoption of biosimilar infliximab for rheumatoid arthritis, ankylosing spondylitis, and inflammatory bowel diseases in the EU5: a budget impact analysis using a Delphi panel. Front Pharmacol. 2017;8:322.

32. Wallace ZS, Harkness T, Blumenthal KG, Choi HK, Stone JH, Walensky RP. Increasing operational capacity and reducing costs of rituximab administration: a costing analysis. ACR Open Rheumatol. 2020;2(5):261-8.

33. Teran E, Gomez H, Hannois D, Lema M, Mantilla W, Rico-Restrepo M, et al. Streamlining breast cancer and colorectal cancer biosimilar regulations to improve treatment access in Latin America: an expert panel perspective. Lancet Oncol. 2022;23(7):e348-e358.

|

Author for correspondence: Nicolás Armijo, MSc, Health Technology Assessment Unit, Pontifi cia Universidad Católica de Chile, Diagonal Paraguay 362, Santiago, Chile |

Disclosure of Conflict of Interest Statement is available upon request.

Copyright © 2024 Pro Pharma Communications International

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

MINUCIOSA EVALUACION