Patent expiry dates for biologicals: 2018 update

Published on 2015/03/24

Generics and Biosimilars Initiative Journal (GaBI Journal). 2019;8(1):24-31.

|

Abstract: |

Submitted: 31 January 2019; Revised: 6 February 2019; Accepted: 7 February 2019; Published online first: 15 February 2019

Introduction

Biologicals represent many of the most promising new therapies for previously intractable diseases and are becoming increasingly important in the pharmaceuticals market. The global biological market is worth approximately US$276 billion, and in 2018 seven of the top 10 best-selling drugs were biologicals compared with only three in 2008 [1, 2]. The biosimilar market is also rapidly growing, however, it accounts for less than 2% of global sales of biologicals (4.6% of European sales) [3].

Cancer, autoimmune diseases, and diabetes treatments account for over 60% of the biologicals market. With increasing prevalence of chronic diseases, the biologicals pipeline is expanding rapidly, with around 800 products thought to be in the pipeline at present. In 2016, approximately 50% of new molecular entities approved by the US Food and Drug Administration (FDA) were biologicals [4].

Costs savings associated with substituting biologicals with biosimilars

Biologicals are extremely expensive and prices are increasing rapidly [5]. By 2022, annual wholesale prices of biologicals are predicted to increase by 8% to 11%, and net prices by 2% to 5%. Prices of new cancer medicines have risen by up to tenfold during the past decade and now average US$150,000 or more per year of life gained [6]. The increasing prices of cancer drugs are, according to the World Health Organization (WHO), ‘impairing the capacity of healthcare systems to provide affordable, population-wide access to cancer medicines’ [7]. One way to combat the increasing costs associated with the use of biologicals and the subsequent pressure on healthcare budgets is to introduce biosimilars where the patents and exclusivity periods of the originator biologicals have expired. By 2018, biologicals worth more than US$68 billion in annual sales lost patent protection. A 20% discount could save US$14 billion, while a 30% or 40% discount could save US$20 billion or US$27 billion, respectively [8]. A UK study of patients with rheumatoid arthritis or psoriasis treated with etanercept has shown that substantial savings can be made by using the etanercept biosimilar GP2015. The results of the study indicated that GP2015 could offer cost savings of between GBP 4.8 million (10% discount scenario) and GBP 14.3 million (30% discount scenario). These savings could enable between 568 (10% discount scenario) and 2,191 (30% discount scenario) more patients to receive treatment with etanercept [9]. Another study estimated using a budget impact model that use of the rituximab biosimilar CT-P10 rather than the originator biological could save Euros 90 million in Europe in the first year alone [10].

Patent and exclusivity period expiry

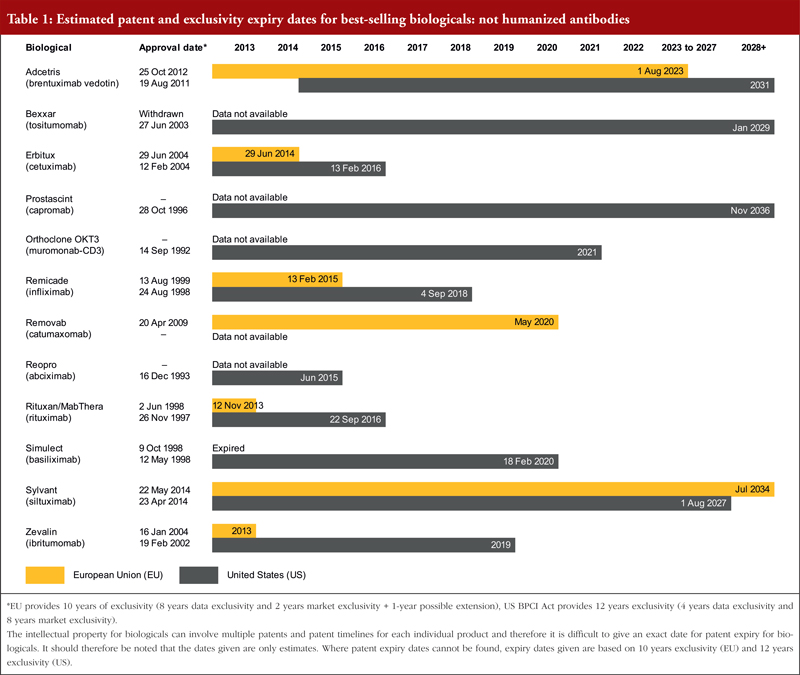

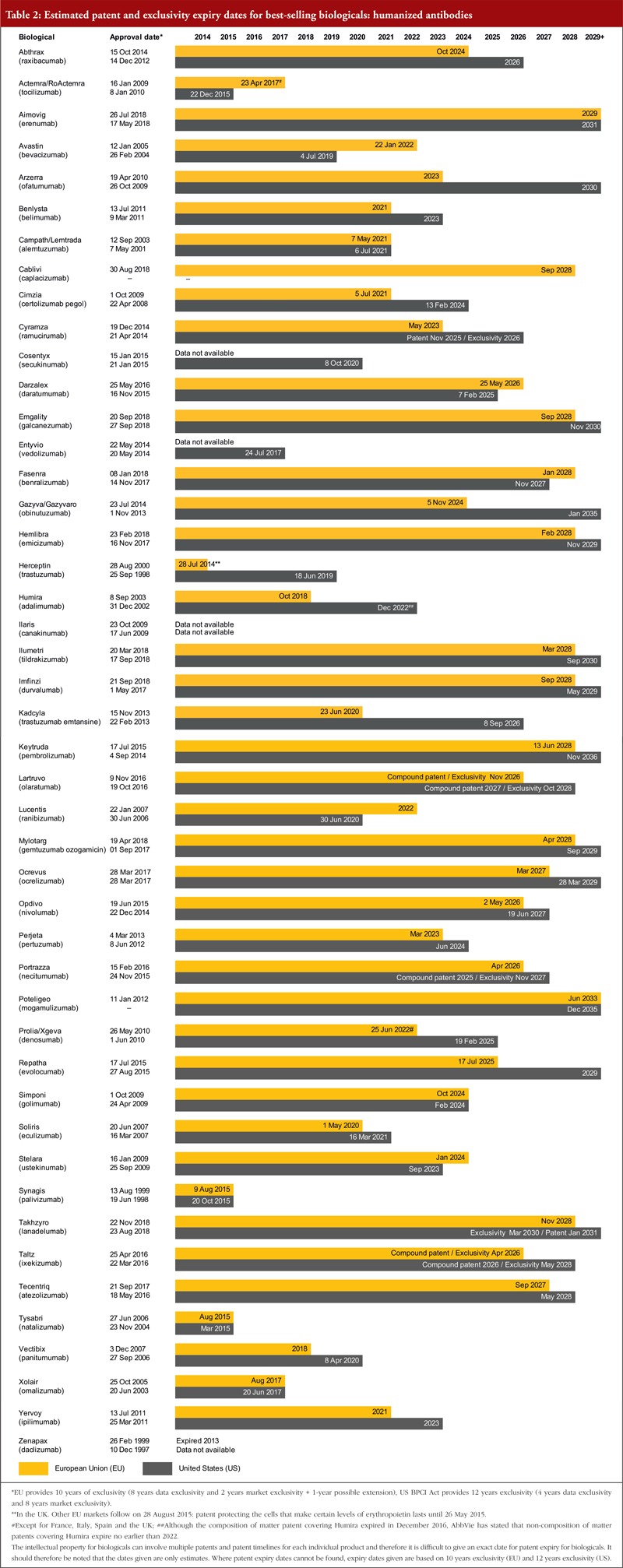

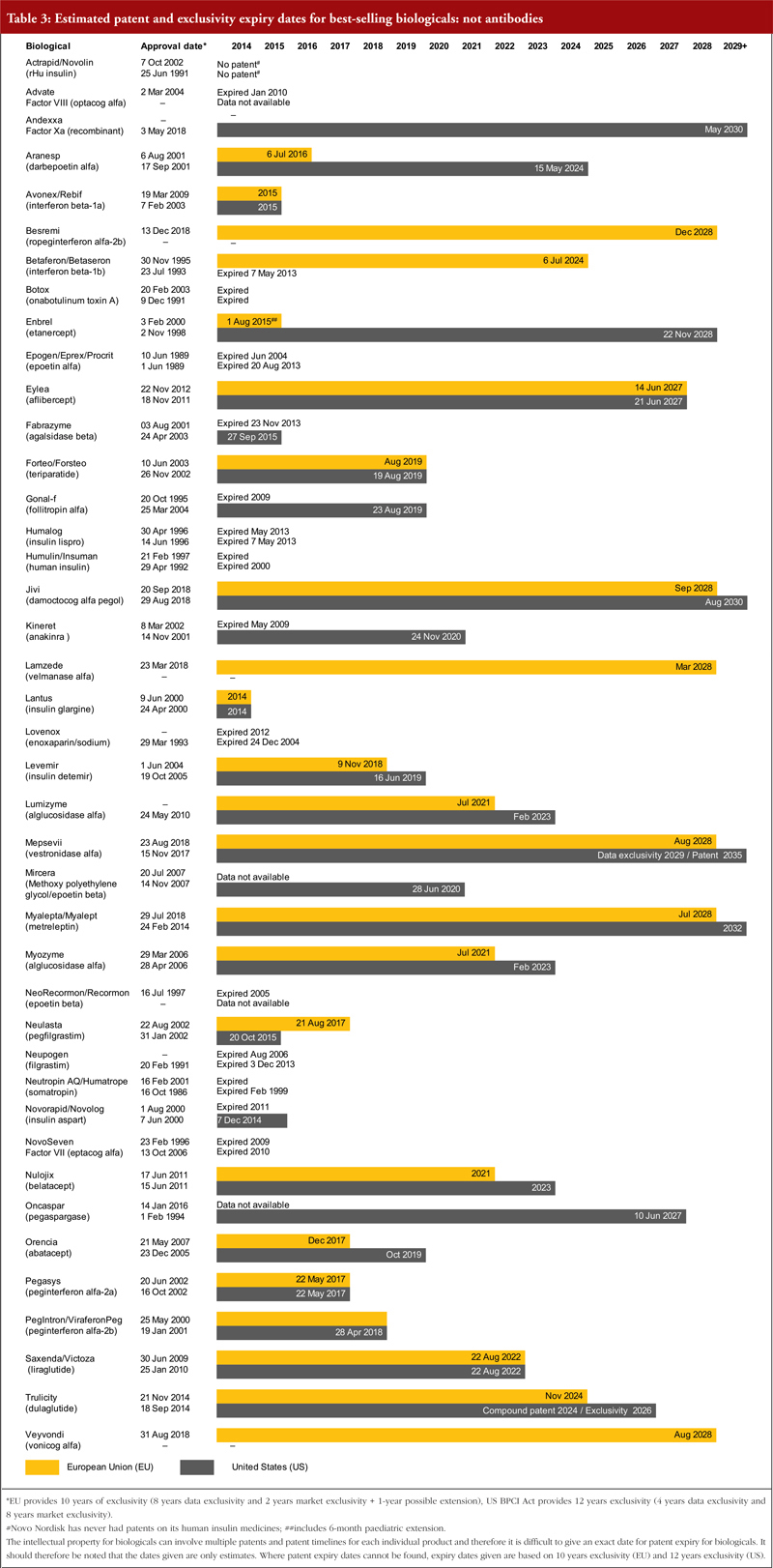

There has been significant global harmonization regarding patents, largely as a result of the World Trade Organization’s (WTO) TRIPS agreement (Agreement on Trade-Related Aspects of Intellectual Property Rights). As a result, most patent laws now give the term of a patent as 20 years from the filing date of the application [11]. For both Europe and the US, exclusivity periods should also be considered, see footnote of Tables 1, 2 and 3. Estimated patent and exclusivity period expiry dates for some of the best-selling biological molecules are presented in Tables 1, 2 and 3 for not humanized antibodies, humanized antibodies and biologicals that are not antibodies.

The EU previously defined a period of 10 years data exclusivity, however, this was revised at the latest review of EU pharmaceutical legislation. Data exclusivity is now defined as 10 years if the reference product is centrally approved or if the application to the centralized procedure was made before 20 November 2005. If a full dossier was submitted on or after 30 October 2005 via a national procedure, or after 20 November 2005 via the centralized procedure, it would be 8 years data exclusivity plus 2 years market exclusivity plus 1 year possible extension [12, 13]. The expiration of patents and other intellectual property rights for originator biologicals over the next decade will create opportunities for biosimilars to enter the market and increase industry competition.

Growth of the biosimilars market

The global market for biosimilars is expected to increase from US$5.95 billion in 2018 to US$23.63 billion by 2023 according to a report by Markets and Markets. This represents a compound annual growth rate (CAGR) of 31.7% and more than doubles the 2017 market value estimation of US$10.9 billion [14]. Geographically, the biosimilars market is dominated by Europe, followed by Asia, North America and the rest of the world; Europe is expected to hold the largest share of the biosimilars market at least until 2023. Growth of the biosimilars market in Europe is primarily driven by the need to reduce healthcare costs, the expiration of biological patents and the arrival of new biosimilars, as well as the increasing incidence of chronic diseases. The Asian market is projected to grow at the highest CAGR from 2018 to 2023 [14].

Guidelines and approval of biosimilars

Europe first developed guidelines for the approval of biosimilars via an abbreviated registration process in 2005 to 2006, and the European Medicines Agency (EMA) has since developed multiple general and specific guidelines for biosimilars [15]. EMA approved its first biosimilar Omnitrope (somatropin) in 2006 and has since then approved 59 biosimilars within the product classes of human growth hormone, granulocyte colony-stimulating factor, erythropoiesis-stimulating agent, insulin, follicle-stimulating hormone, parathyroid hormone, tumour necrosis factor-inhibitor and monoclonal antibody [16].

The US has been slower than Europe in paving the way for biosimilars. The US Patient Protection and Affordable Care Act created an abbreviated licensure pathway for biosimilars known as the 351(k) pathway, under the Biologics Price Competition and Innovation Act of 2009 (BPCI Act). Although this was signed into law in 2010, final guidance on the implementation of the 351(k) pathway was not issued until 2015 [17]. FDA approved its first biosimilar in 2015 and to date (January 2019) it has approved only 16 biosimilars and two follow-on biologicals [12]. The US has proved to be a difficult market to penetrate, with many biosimilar candidates being rejected at least initially [18–22]. One such rejection has resulted in Sandoz, the generics division of Novartis, deciding not to pursue the biosimilar rituximab in the US [23]. The slow growth of the US biosimilar market has been attributed to a combination of factors including naming, interchangeability guidance, insurance payment arrangements and secrecy about manufacturing processes [24]. FDA is implementing a number of initiatives to improve access to biosimilars in the US. It released its Biosimilars Action Plan in July 2018, which aims to improve the efficiency of the biosimilar and interchangeable product development and approval process, maximize clarity for developing biosimilars, develop effective communications to improve understanding of biosimilars and support market competition. In 2017, FDA approved a total of seven biosimilars, a record approval rate, and has more than 60 ongoing biosimilar development programmes [25]. In addition, two biosimilars, Udenyca (pegfilgrastim-cbqv) and Retacrit (epoetin alfa-epbx), were launched in 2018 in the US at a significant discount to the brand-name biologicals [26].

Challenges relating to uptake of biosimilars

Despite leading the field in the biosimilars market, Europe has faced challenges relating to uptake. Uptake varies significantly between countries in Europe, with some, such as Italy and Spain, having relatively low use of biosimilars compared with countries where there is high acceptance of biosimilars, such as Austria, Germany, The Netherlands and Sweden [27]. This difference may be due to the use of different biosimilar policies; surveys carried out by European Biopharmaceutical Enterprises (EBE) have revealed significant variation in biosimilar policies in Europe. The EBE investigates pricing, tendering, substitution and international non-proprietary name prescribing policies for biosimilars in 42 countries (the EU-28 plus countries within the European region as defined by WHO, Canada and South Africa). Findings from EBE surveys suggest that one of the most important challenges for policymakers will be establishing effective measures to enhance biosimilar uptake, which will generate savings to fund innovation and ensure the sustainability of healthcare systems [28, 29]. Positive data from clinical trials of biosimilars as well as stakeholder education are likely to increase confidence in biosimilars and boost their uptake. Several clinical trials comparing originator and biosimilar infliximab have demonstrated that patients can safely and effectively be switched from the originator product to the biosimilar [30–33]. Real-world data and findings from discussions with patient groups, clinicians, healthcare professional organizations, government bodies and industry have shown that a long-term, multi-stakeholder policy framework for off-patent biologicals and biosimilars is required to increase uptake [34, 35].

Price reduction strategies, including mandatory discounts, reimbursement procedures, tendering co-payments, incentivization of stakeholders and prescribing incentives are expected to increase the adoption of biosimilars among physicians and patients [36–38]. Aggressive price discounts have been observed in markets with multiple biosimilar entrants. This was seen in the launch of Zarxio in the US in 2015 [39], and in 2018 epoetin alfa and pegfilgrastim biosimilars were launched in the US at a significant discount compared with their originator products. Udenyca (pegfilgrastim-cbqv) was launched at a 33% discount compared with the originator pegfilgrastim Neulasta, and Retacrit (epoetin alfa-epbx) was launched at a 57% discount compared with the originator epoetin alfa, Procrit [40].

Major players in the biosimilars market

Key players in the biosimilars market include Amgen, Apotex, Biocon, Boehringer Ingelheim, Celltrion, Samsung Bioepis, Pfizer and Sandoz. Other important companies developing biosimilars include Dr Reddy’s Laboratories, Eli Lilly, Fuji Pharma, Merck and Teva Pharmaceuticals. Many South Korean and Japanese companies are working on biosimilars, including BIOCND, Chong Kun Dang Pharmaceutical, Daiichi Sankyo, Fujifilm Kyowa Kirin Biologics, GC Pharma, Hanwha Chemical, LG Life Sciences, Mochida Pharmaceutical, Nichi-Iko Pharmaceutical, Nippon Kayaku, PanGen Biotech and Polus Biopharm. Chinese companies, such as Bio-Thera Solutions, Gan & Lee, Genor Biopharma, Hisun Pharmaceuticals, Innovent Biologics, MabTech, NT Pharma, Shanghai Biomabs Pharmaceuticals, Shanghai CP Guojian Pharmaceutical, Shanghai Henlius Biotech (Fosun Pharma) and Sinocelltech, are working on copy biologicals. Indian companies working on ‘similar biologics’ include Cadila Healthcare, Claris Lifesciences, Emcure, Epirus Biopharmaceuticals, Glenmark Pharmaceuticals, Hetero Group, Intas Pharmaceuticals, Reliance Life Sciences, Ranbaxy, Torrent Pharmaceuticals, USV, Wockhardt, Zenotech Laboratories and Zydus Cadila. In Latin America, companies including Biosidus and Laboratorio Elea from Argentina and Probiomed from Mexico are developing medicamento biològico similares.

Competing interests: None.

Provenance and peer review: Article prepared based on extensive research; internally peer reviewed.

Michelle Derbyshire, PhD, GaBI Online Editor; Sophie Shina, MSc, GaBI Journal Editor

References

1. IGEA Hub. 20 Best selling drugs 2018 [homepage on the Internet]. [cited 2019 Feb 6]. Available from: www.igeahub.com/2018/04/07/20-best-selling-drugs-2018/

2. GaBI Online – Generics and Biosimilars Initiative. Biologicals dominate Europe’s best sellers [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Reports/Biologicals-dominate-Europe-s-best-sellers

3. GaBI Online – Generics and Biosimilars Initiative. Developing biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Reports/Developing-biosimilars

4. Research and Markets. Global biologics market size, market share, application analysis, regional outlook, growth trends, key players, competitive strategies and forecasts, 2018 to 2026 [homepage on the Internet]. [cited 2019 Feb 6]. Available from: www.researchandmarkets.com/reports/4564281/global-biologics-market-size-market-share

5. GaBI Online – Generics and Biosimilars Initiative. Barriers to biologicals competition [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Barriers-to-biologicals-competition

6. Haycox A, Godman B, Wild C. Patent expiry and costs for anticancer medicines for clinical use. Generics and Biosimilars Initiative Journal (GaBI Journal). 2017;6(3):105-6. doi:10.5639/gabij.2017.0603.021

7. GaBI Online – Generics and Biosimilars Initiative. WHO considers cost of cancer drugs and how to increase access [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Reports/WHO-considers-cost-of-cancer-drugs-and-how-to-increase-access

8. Ekman N, Cornes P, Vulto AG. Reducing healthcare costs and building trust in biosimilar medicines. Generics and Biosimilars Initiative Journal (GaBI Journal). 2016;5(2):84–8. doi:10.5639/gabij.2016.0502.020

9. GaBI Online – Generics and Biosimilars Initiative. Savings to be made by using etanercept biosimilar in UK [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Savings-to-be-made-by-using-etanercept-biosimilar-in-UK

10. GaBI Online – Generics and Biosimilars Initiative. Rituximab biosimilar CT-P10 could save Europe Euros 90 million in its first year [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Rituximab-biosimilar-CT-P10-could-save-Europe-Euros-90-million-in-its-first-year

11. Derbyshire M. Patent expiry dates for biologicals: 2017 update. Generics and Biosimilars Initiative Journal (GaBI Journal). 2018;7(1):29-34. doi:10.5639/gabij.2018.0701.007

12. GaBI Online – Generics and Biosimilars Initiative. Biosimilars approved in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-the-US

13. European Commission. Volume 2A Procedures for marketing authorisation Chapter 1 Marketing authorisation. July 2015 [homepage on the Internet]. [cited 2019 Feb 6]. Available from: www.ec.europa.eu/health/sites/health/files/files/eudralex/vol-2/a/vol2a_chap1_201507.pdf

14. Markets and Markets. Biosimilars market by product (recombinant non-glycosylated proteins (insulin, rhgh, interferon), glycosylated (mab, epo), peptides (glucagon, calcitonin)), manufacturing type (in-house, contract), disease (oncology, autoimmune) – global forecast to 2023 [homepage on the Internet]. [cited 2019 Feb 6]. Available from: www.marketsandmarkets.com/Market-Reports/biosimilars-40.html

15. GaBI Online – Generics and Biosimilars Initiative. EU guidelines for biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Guidelines/EU-guidelines-for-biosimilars

16. GaBI Online – Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

17. GaBI Online – Generics and Biosimilars Initiative. US guidelines for biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Guidelines/US-guidelines-for-biosimilars

18. GaBI Online – Generics and Biosimilars Initiative. FDA rejects pegfilgratim biosimilar from Coherus [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/FDA-rejects-pegfilgrastim-biosimilar-from-Coherus

19. GaBI Online – Generics and Biosimilars Initiative. FDA rejects Sandoz’s biosimilar pegfilgrastim application [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/FDA-rejects-Sandoz-s-biosimilar-pegfilgrastim-application

20. GaBI Online – Generics and Biosimilars Initiative. FDA rejects Amgen’s trastuzumab biosimilar [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/FDA-rejects-Amgen-s-trastuzumab-biosimilar

21. GaBI Online – Generics and Biosimilars Initiative. FDA rejects Pfizer’s epoetin alfa biosimilar [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/FDA-rejects-Pfizer-s-epoetin-alfa-biosimilar

22. GaBI Online – Generics and Biosimilars Initiative. FDA rejects trastuzumab and rituximab biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/FDA-rejects-trastuzumab-and-rituximab-biosimilars

23. GaBI Online – Generics and Biosimilars Initiative. Boehringer Ingelheim and Sandoz abandon biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/General/Boehringer-Ingelheim-and-Sandoz-abandon-biosimilars

24. GaBI Online – Generics and Biosimilars Initiative. Obstacles to the use of biosimilars in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Obstacles-to-the-use-of-biosimilars-in-the-US

25. GaBI Online – Generics and Biosimilars Initiative. FDA releases guidances and proposed rule to advance biosimilars policy framework [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Guidelines/FDA-releases-guidances-and-proposed-rule-to-advance-biosimilars-policy-framework

26. GaBI Online – Generics and Biosimilars Initiative. Biosimilars launched in the US at a significant discount [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/Biosimilars-launched-in-the-US-at-a-significant-discount

27. GaBI Online – Generics and Biosimilars Initiative. Biosimilars use in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Reports/Biosimilars-use-in-Europe

28. Curto A. Trends and challenges in biosimilars pricing and reimbursement policies in Europe and beyond. Generics and Biosimilars Initiative Journal (GaBI Journal). 2017;6(2):56-7. doi:10.5639/gabij.2017.0602.012

29. Roediger A, Freischem B, Reiland J-B. What pricing and reimbursement policies to use for off-patent biologicals in Europe? – results from the second EBE biological medicines policy survey. Generics and Biosimilars Initiative Journal (GaBI Journal). 2017;6(2):61-78. doi:10.5639/gabij.2017.0602.014

30. GaBI Online – Generics and Biosimilars Initiative. Switching to biosimilar infliximab in IBD patients [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Switching-to-biosimilar-infliximab-in-IBD-patients

31. GaBI Online – Generics and Biosimilars Initiative. Switching from reference infliximab to CT P13 in IBD patients [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Switching-from-reference-infliximab-to-CT-P13-in-IBD-patients

32. GaBI Online – Generics and Biosimilars Initiative. Positive phase III switching results for Celltrion’s infliximab biosimilar [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Positive-phase-III-switching-results-for-Celltrion-s-infliximab-biosimilar

33. Perks B. Randomized non-inferiority trial fails to find inferiority switching from infliximab originator to CT-P13 biosimilar. Generics and Biosimilars Initiative Journal (GaBI Journal). 2017;6(4):188–9. doi:10.5639/gabij.2017.0604.042

34. Carroll D, O’Brien GL, Mulcahy M, Walshe V, Courtney G, Byrne S. Biosimilar infliximab introduction into the gastroenterology care pathway in a large acute Irish teaching hospital: a story behind the evidence. Generics and Biosimilars Initiative Journal (GaBI Journal). 2018;7(1):14-21. doi:10.5639/gabij.2018.0701.004

35. van Bodegraven AA, Süle A, Celano A, Llombart-Cussac A, Jorgensen F, De Cock J, et al. How to realize the potential of off-patent biologicals and biosimilars in Europe? Guidance to policymakers. Generics and Biosimilars Initiative Journal (GaBI Journal). 2018;7(2):70-4. doi:10.5639/gabij.2018.0702.014

36. GaBI Online – Generics and Biosimilars Initiative. International supply side policies for biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Reports/International-supply-side-policies-for-biosimilars

37. GaBI Online – Generics and Biosimilars Initiative. International prescribing incentives for biosimilars [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Reports/International-prescribing-incentives-for-biosimilars

38. GaBI Online – Generics and Biosimilars Initiative. Biosimilar policies in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/Research/Biosimilar-policies-in-Europe

39. Sarshad M. Major lessons learned from Zarxio’s US launch: the start of a biosimilar revolution. Generics and Biosimilars Initiative Journal (GaBI Journal). 2017;6(4):165-73. doi:10.5639/gabij.2017.0604.035

40. GaBI Online – Generics and Biosimilars Initiative. Biosimilars launched in the US at a significant discount [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2019 Feb 6]. Available from: www.gabionline.net/Biosimilars/News/Biosimilars-launched-in-the-US-at-a-significant-discount

Disclosure of Conflict of Interest Statement is available upon request.

Copyright © 2019 Pro Pharma Communications International

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Why tables are not getting uploaded. Its saying ‘pending to be upload’

Thanks

Sumit

I really appreciate to be able to read your valuable research report.

I want to use some patent data for non-commercial use. but it’s hard to read drug name.

The resolution of your table data are low. Can I see other site? or obtain your table data directly?

Dear Sumit Tiwari,

We very much appreciate your kind feedback, the tables are uploaded onto the website, please continue with your valuable comment to GaBI Journal.

Thank you for your interest in GaBI. Please enjoy the quality information and content published under GaBI (GaBI Online and GaBI Journal).

GaBI Journal Editorial Office

Looks like Table 3 didn’t load correctly. Great article though!

Dear Dr Dawn Ecker,

We very much appreciate your kind feedback, the table 3 of the article ‘Patent expiry dates for biologicals: 2018 update’ is uploaded on the website, please continue with your valuable comment to GaBI Journal.

Thank you for your interest in GaBI. Please enjoy the quality information and content published under GaBI (GaBI Online and GaBI Journal).

GaBI Journal Editorial Office