Patent expiry dates for biologicals: 2016 update

Published on 2017/01/23

Generics and Biosimilars Initiative Journal (GaBI Journal). 2017;6(1):27-30.

|

Abstract: |

Submitted: 16 December 2016; Revised: 20 December 2016; Accepted: 22 December 2016; Published online first: 4 January 2017

With biologicals making up a larger share of the new drugs approved in both Europe and the US, the pricing of drugs, and the impact of those prices on healthcare budgets, is poised to become a big issue. One way to offset these costs is to introduce biosimilars for biologicals where the patents and exclusivity periods have expired.

The European Medicines Agency (EMA) approved its first biosimilar, Omnitrope (somatropin), back in 2006 [1]. Since then, EMA has approved 24 biosimilars within the product classes of human growth hormone, granulocyte colony-stimulating factor (G-CSF), erythropoiesis stimulating agent, insulin, follicle-stimulating hormone (FSH), parathyroid hormone, and tumour necrosis factor (TNF)-inhibitor, for use in the European Union (EU).

Many blockbuster biologicals are already, or will soon be, facing competition from biosimilars due to patent expiries and loss of exclusivity. There are also more than 200 new biotechnology products in the pipeline (phase II to registered), all of which could be future targets for biosimilars. With the increasing price of new biologicals and continuing pressure on healthcare budgets, biosimilars are expected to make up an increasing share of the biologicals market.

There has been significant harmonization across the globe with respect to patents, mainly as a result of the World Trade Organization’s TRIPS agreement (Agreement on Trade-Related Aspects of Intellectual Property Rights). This has resulted in most patent laws nowadays giving the term of a patent as 20 years from the filing date of the application. This is the case both in Europe and the US, where patents have a term of 20 years from the date of filing [2].

For both Europe and the US, exclusivity periods should also be considered (see footnote in Tables 1 to 3).

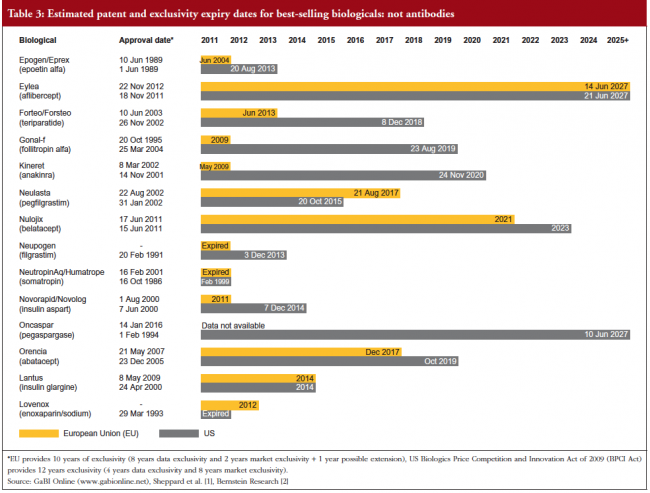

Estimated patent and exclusivity period expiry dates for just some of the best-selling biological molecules are shown in Tables 1 for not humanized antibodies, Table 2 for humanized antibodies, and Table 3 for biologicals that are not antibodies.

Although the EU previously defined a period of 10 years data exclusivity, this was revised at the latest review of pharmaceutical EU legislation to the following:

Ten years if the reference product is centrally approved or application to the centralized procedure has been made before 20 November 2005. Or eight years data exclusivity + 2 years market exclusivity + 1 year possible extension if a full dossier is submitted on or after 30 October 2005 via a national procedure or after 20 November 2005 via the centralized procedure [3].

The expiration of patents and other intellectual property rights for originator biologicals over the next decade opens up opportunities for biosimilars to enter the market and increase industry competition. Price reduction strategies should increase adoption among physicians and patients alike, spurring increases in the biosimilars market share.

According to a report by Grand View Research, the global market for biosimilars will experience rapid growth from 2016 to 2024. The biosimilars market is expected to reach US$41.7 billion in 2024, with the most significant factor contributing to this growth being patent expiries on major biologicals. Demand is also being fuelled by governments around the world turning to biosimilars as a cheaper option to reduce healthcare costs.

Although the US is the largest biologicals market globally, it is still playing catch up when it comes to biosimilars. The US Food and Drug Administration (FDA) only approved its first biosimilar in 2015 and to date (January 2017) has approved four biosimilars [3], compare to 24 biosimilars currently approved in the EU [1]. The US therefore currently accounts for only a small part of the global biosimilars market, while Europe is the largest contributor to biosimilar revenues worldwide.

The EU, however, is not without its problems. Uptake of biosimilars varies significantly between the different countries of the EU, with some, such as Italy and Spain, having quite low biosimilars use compared to countries where there is high acceptance of biosimilars, e.g. Austria, Germany, The Netherlands and Sweden [4]. However, favourable clinical outcomes demonstrated through clinical trials of biosimilars, including in the NOR-SWITCH trial of switching from the originator biological to biosimilar infliximab, are expected to increase confidence and boost uptake of biosimilars [5].

Major companies investing in the biosimilars market include Amgen, Biocad, Biocon, Celltrion, Dr Reddy’s Laboratories, Hospira, Intas Biopharmaceutical, Mylan, Pfizer, Sandoz, Stada Arzneimittel and Teva Pharmaceutical Industries.

Competing interests: None.

Provenance and peer review: Article prepared based on extensive research; internally peer reviewed.

Michelle Derbyshire, PhD, GaBI Online Editor

References

1. GaBI Online – Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2016 Dec 20]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

2. Derbyshire M. Patent expiry dates for best-selling biologicals. Generics and Biosimilars Initiative Journal (GaBI Journal). 2015;4(4):178-9. doi:10.5639/gabij.2015.0404.040

3. GaBI Online – Generics and Biosimilars Initiative. Biosimilars approved in the US [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2016 Dec 20]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-the-US

4. GaBI Online – Generics and Biosimilars Initiative. Biosimilars use in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2016 Dec 20]. Available from: www.gabionline.net/Reports/Biosimilars-use-in-Europe

5. GaBI Online – Generics and Biosimilars Initiative. NOR-SWITCH study finds biosimilar infliximab not inferior to originator [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2016 Dec 20]. Available from: www.gabionline.net/Biosimilars/Research/NOR-SWITCH-study-finds-biosimilar-infliximab-not-inferior-to-originator

Disclosure of Conflict of Interest Statement is available upon request.

Copyright © 2017 Pro Pharma Communications International

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

The information provided on patent expiry of major biologicals are very interesting and informative. It would be highly appreciated if all three tables of high resolutions are provided for our official purpose and not for any commercial reason. Looking forward for your favourable response please.

With regards,

Dr G R SONI, Chief, Biopharma, Department of Biotechnology, Government of India

Dear Dr G R SONI,

Thank you for your valuable comments and insight received on 5 October 2017, the figures for the article ‘Patent expiry dates for biologicals: 2016 update’ are available to view online.

We appreciate very much your kind feedback, and please continue with your valuable comments to GaBI Journal.

Thank you for your interest in GaBI. Please enjoy the quality information and content published under GaBI (GaBI Online and GaBI Journal).

Dear Author,

Request you to provide your rational of calculating the expiry of exclusivity and patent (US) for tocilizumab, ofatumumab, belimumab, alemtuzumab, ramucirumab, secukinumab, ado-trastuzumab, emtansine, pertuzumab, etc. I believe there is some miscalculation in the patent expiry.

regards

ashutosh

Dear Ashutosh Bhargava

Thank you for your valuable comments and insight received on 25 May 2018.

Please be advised that there is an updated 2017 patent expiry article published in GaBI Journal with updated expiry dates, see the following link:

https://gabi-journal.net/patent-expiry-dates-for-biologicals-2017-update.html

If you have any suggestion on to verify the patent expiry data, please advise. We appreciate very much your kind feedback, and please continue with your valuable comments to GaBI Journal.

Thank you for your interest in GaBI. Please enjoy the quality information and content published under GaBI (GaBI Online and GaBI Journal).